GEAB 174

For 17 years, the GEAB has been characterising one by one the phases of the global systemic transition process. As of April 2023, it is very clear that the “new world” (led by the BRICS), after a slow and uncertain revival almost 15 years ago, is now beginning its take-off phase.

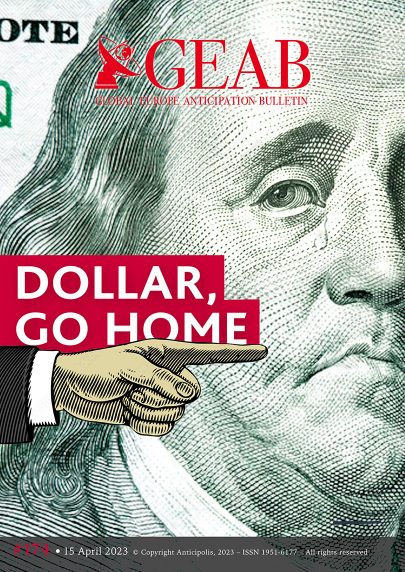

The new world is breaking free of the steps that have both fed it and held it down (the West, the dollar, the Western technology, etc.), and the old world will have to continue its own transformation before it can take off by itself.

Recent news is full of major events, suddenly showing the immense attractiveness of the BRICS: the BRICS have just overtaken the G7 in GDP (31.5% vs. 30.7% of world GDP);[1] Jim O’Neill of Goldman Sachs calls on the BRICS to counter the dollar’s domination of the international monetary system;[2] Saudi Arabia (until recently the pillar of the petrodollar) joins the Shanghai Cooperation Organisation;[3] China emerges as a desirable geopolitical actor to end the Ukrainian crisis;[4] Saudi Arabia and Iran renew diplomatic relations reviving hopes for a solution to the war in Yemen;[5] China holds its second International Forum for Democracy (and the West should not sneer if it wants the rest of the world to continue to pay attention to it);[6] Brazil and China consolidate their rapprochement with a visit by Lula to Beijing;[7] BRICS rumoured to be launching a trading currency based on gold and various other commodities;[8] Yuan replaces dollar as Russia’s most traded currency;[9] Japan bends G7 rules to buy Russian oil;[10] India resists sanctions and buys more Russian oil than ever[11] … The list goes on and on, illustrating the speedy and strong BRICS dynamics now imposing themselves, dynamics of prosperity that cannot leave untouched the most free-moving players. Last January, we warned about China’s awakening after its three-year pause.[12] We could not see things better.

On the Western side, the most pragmatic interests call for looking towards these energies of global transformation: in addition to Jim O’Neill’s calls, we note the intensity of business trips to Beijing carrying the flagship of Western companies[13] and finance[14] led (or not) by heads of state (Macron,[15] Scholz,[16] Sanchez[17] …).

But the heavy Western superstructure remains stuck to the ground: too heavy, too many things to lose, too big to move. One banking crisis follows another, taking in its wake part of the American tech industry (SVB), the Swiss-centric banking system (Credit Suisse), and in a logical sequence, no doubt soon, central banks and over-indebted sovereign states.

At the heart of this earthquake is the end of the dollar’s global hegemony, as we shall see in this issue, which represents a reversal of trend of unprecedented violence, for which the BRICS had a 15-year-preparation phase, under the erratic efforts by Europe and the US to keep up which are close to null.

The West’s inability to get out of the war in Ukraine is leading to the mass departure of all that can move: clients withdraw their assets from a dilapidated banking system;[18] even if it means losing 1 billion USD, Saudi Arabia withdraws from Credit Suisse causing its collapse;[19] the Senegalese burn French supermarkets and petrol stations;[20] Africans warn the West of their usual condescending behaviour[21] … It is a gigantic flight out of the Western system that is taking place and that the GEAB had described 2 years ago.[22]

Faced with such a collapse of all its certainties, the West’s stupefaction will lead it to close its ranks even more. But this tightening will accentuate the departure of the free players such as companies and small states (Switzerland), or on the contrary the most dependent ones such as the most indebted states facing the prospect of sovereign defaults (Italy, France,… and why not the United States). Even the Eastern Europe is beginning to realise the danger of the crystallisation of a confrontation with the Russian neighbour (tensions are rising between Poland and Ukraine;[23] the Slovaks are revealing their pro-Slavic DNA;[24] the Bulgarians voted for a pro-Russian party in the last elections,[25]…). And, despite a certain collapse of China’s image in Eastern Europe,[26] we anticipate that economic pragmatism combined with the absence of a painful history with the Middle Kingdom will soon dampen the pro-Taiwan vehemence of this region.

The French President recently made it clear that the European economy could not afford to follow a sanctions regime against China given the great damage already inflicted by the confrontation with Russia alone.[27] Certainly, France may face some retaliation in the coming weeks as a result of these statements, but the fact that Macron is taking the risk indicates how vital it is for France not to continue to be trapped in the wars of others.

A few Western ideological entities disconnected from human and economic realities will continue to dominate the anti-‘new world’ diatribe successfully for some time to come, namely the European Commission and the transatlantic axis led by NATO. But we can date the beginning of the end of Western superstructures to 2024, in the context of the double election of the US on one side and the EU on the other, which will either collapse under the blow of war (hard molting scenario) or will be transformed under the questioning by their members (soft molting scenario) – a questioning that would concern quite effectively the democratic legitimacy of these institutions.

The conditions for the change will then be met, led by the actors most anchored in reality, namely the States, called upon to rebuild a new system on the basis of the resource-currency pairing.[28]

And the old world will be able to “take its turn”, freed from the structures of the past.

Not a GEAB reader yet ? Subscribe

Join also the GEAB Community on LinkedIn for more discussions on this topic.

___________________

[1] Source: Watcher Guru, 08/04/2023

[2] Source: Bloomberg, 28/03/2023

[3] Source: OilPrice, 04/04/2023

[6] Source: AfricaNews, 27/03/2023

[7] Source: Reuters, 11/04/2023

[8] Source: IndiaTimes, 04/04/2023

[9] Source: Bloomberg, 03/04/2023

[10] Source: Wall Street Journal, 02/04/2023

[14] Source: Reuters, 31/03/2023

[15] Source: Foreign Policy, 05/04/2023

[16] Source: TheEconomist, 02/11/2022

[17] Source: MFA China, 31/03/2023

[20] Source: Trendtype, 11/03/2023

[24] Source: Euractiv, 15/09/2022

[27] Source: The Guardian, 10/04/2023

[28] A pairing that anticipates the central role the euro zone is expected to play.

For almost 20 years we have been anticipating a revolution in the international monetary system and in particular the emancipation of the global economy from the trade vehicle of the [...]

Climate change has been shifting our relationship with water, bringing power and politics into human rights issues of access and management, because the powerless is particularly hit by this. Besides [...]

Bogdan Herea, founder and CEO of PitechPlus (a full-cycle software development company) and founder of Academy+Plus (a Romanian Ecole 42), is what some call the "Romanian Xavier Niel" . His [...]

2023 - From dollar shortage to a multi-directional financial crisis... until better times are coming In support of our urgent recommendation to diversify in the face of a major financial [...]

Comments