GEAB 117

Qatar, North Korea, the Baltic Sea, risk of a World War III… and all the military ranting mentioned in the media lately, are issues going hand in hand with the programmed and imminent advent of the catastrophic scenario for the dollar as a unique world reference currency: the Petro-Yuan will be in place at the end of the year. More than a petro-currency, it will be a petro-gas-gold-currency! The West is thus preparing to switch to total anachronism with this founding act of the 21st century multipolar world. 2014-2017: here we are, at the end of a three-year exacerbation period of tensions on all front lines (West against the rest of the world) and we are witnessing the up-coming end of the dollar’s reign over the world and over all financial systems and their related economic activities. Sanctions, blockades, proxy-wars, direct military threats… the question is whether the current clash of arms is really a warning sign of an Nth suicide of the West whilst hoping in vain to stop time, or whether the solution conveying power is on the verge of carrying away all possible resistance.

What a nice topic for the GEAB, knowing our experts have anticipated for 11 years now the evolutions of what we have always called a “global systemic crisis”, but which since 2014 and the Euro-Russian crisis essentially became a “Western systemic crisis”[1]. Its outcome will most probably take one of the following three shapes: dislocation of the West, along the lines of multi-polarisation and by including a process of differentiation between Europe and the US and the return of “exotic” lands to their natural regions – eg. Japan and South Korea; explosion of the West, by triggering direct conflicts against its “adversaries” (Russia, China); “Iron curtain” on the West, by carrying out an indefinite strategic withdrawal accompanied by political and economic asphyxiation.

Indicators of the three trends currently coexist, something which actually complicates the anticipation work already blurred by the strong emotional component; the latter is conveyed both by the gravity of the stakes and the complete collapse of the Western information system. Our team is simply dismayed by the lack of information within the Western and mainly European media on the facts discussed further on in this article (you will notice that the references belong mostly to Asian, African and Middle Eastern journals).

The magnet effect of the brand new Petro-Yuan!

The world’s biggest oil importer, China is preparing to launch gold-backed Yuan-denominated oil futures, possibly creating the most important Asian benchmark in the oil sector, allowing oil exporters to switch from US dollar-denominated assets by transactions in Yuan[2]. To make the Yuan-denominated contracts more attractive, China plans to have the Yuan fully convertible into gold on the Shanghai and Hong Kong foreign exchange markets. Last month, the Shanghai Futures Exchange and its subsidiary, the Shanghai International Energy Exchange (INE) successfully completed four production environment tests for crude oil futures; also, the exchange continues with preparatory work for crude oil futures contracts, aiming to launch operations at the end of this year. China’s Yuan asset value – coupled with the Hong Kong Stock Exchange’s plan to sell Yuan-denominated physical gold futures – will create a system helping countries to bypass the US banking system.

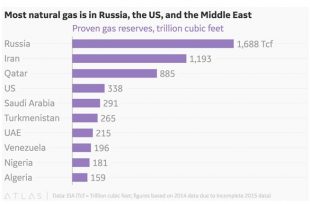

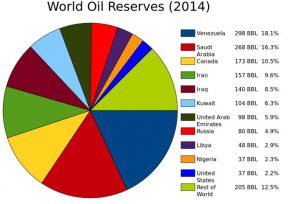

The countries which will immediately benefit from this revolution are, of course, the countries under Western sanctions, such as Russia, Iran, Venezuela… Those mentioned countries are, by the way, sitting on the world’s largest reserves of gas and oil, that is the reason why we are talking of petro-gas-Yuan, knowing that gas represents the energy of the future much more than oil does.

Figure 1 – World gas reserves. Source: EIA, 2015

Figure 2 – World oil reserves. Source: Wikimedia Commons, 2014

Iran and Venezuela have particularly suffered from their isolation from the international system which stopped them from investing significantly in production infrastructures, their potential being therefore largely untapped; these two countries will lose no time in using the opportunity opened by the petro-Yuan. Iran[3] and Russia[4] mainly, but also other smaller producers like Angola[5] and Nigeria[6], are already selling their oil and gas for Yuan to China. But the inconvertibility of the Yuan leads to the development of a Yuan zone outside the international system, without any official existence, with all the uncertainties for the producers concerned about the future of this share of monetary reserves. But everything will change with these new futures, which now come with clear instructions from China, a country already sick of the almighty dollar reign: “From now on, we will favour producers who agree to sell us their energy in Yuan!”

Which brings us to Qatar…

Over the past two years, Qatar has had more than $86 billion transactions in Yuan[7]. This summer, it also became friends with Iran[8], the country sharing with it the largest natural gas field in the world; this allows Qatar to restart drilling after its 12-year moratorium, thus exploiting the gigantic reserve which makes it the third largest gas power in the world. In short, the Sunni and pro-Western Qatar, friend with Iran and China, is now risking bringing along Saudi Arabia, an alliance which would obviously sign the end of the petrodollar; hence the feverish agitation that gripped the region at the end of the spring. But the banning policies and the boycott have thrown countries into the arms of the “Other World”, which has become an irresistible magnet.

Will Saudi Arabia swing over to the other side?

The context has changed rapidly: gas dethroned oil, Saudi Arabia starts to invest in gas extraction infrastructure, the US is now a major competitor of its Saudi strategic ally in terms of gas production (with reduced imports from 14 million barrels a day in 2007 to 8 million barrels in 2017) and the Russians reduce their imports of Saudi oil. All this means that Saudi Arabia, already a victim of the price crisis in the past years[9], must absolutely not risk losing China as a customer as it will end up with vast production reserves which will automatically bring down prices. Besides, the “Other World” provides guarantees of firmness and price stability (via its new OPEC/NOPEP system), guarantees which the West no longer conveys (as the United States does not participate).

Under these circumstances, no wonder that King Salman of Saudi Arabia[10] has just removed from the succession Prince Ben Nayef in favour of Prince Ben Salman, the latter being known for his Russian and Chinese sympathies[11].

Naturally, by accepting to be paid in Yuans, Saudi Arabia risks to lose US military protection. The Chinese are aware of the thorny dilemma they put the country in, and they keep for this matter something up their sleeve: an authorisation to issue treasury bills in Yuan by Saudi Arabia, the creation of a Saudi investment fund and the acquisition of a 5% share of the Saudi Aramco (Saudi Arabian national oil company), which will soon be listed on the international markets[12].

Will it swing over? Will it not? It is the Iranian file, and thus the Saudi military apparatus which can block the evolution via an Iran-Saudi Arabia open conflict. But again, the choice of Ben Salman as heir could play in favour of the swinging operation. Ben Salman is really a major player in the military campaign in Yemen and, as such, is close to the military apparatus of his country, which is probably 100% confident in him.

Another argument in favour of a reversal of Saudi Arabia: the region. We have seen that Qatar has already taken sides. Kuwait and the Sultanate of Oman, faithful to the principles of a neutral foreign mediation oriented policy (especially in the Yemen related conflict[13]), have all refused to take a stand and actually find themselves in the opposite camp. The historical proximity of Kuwait and Russia is well known and the Sultanate of Oman is happily the air hub of the Qataris, instead of Dubai[14]. Turkey, as our readers have known before anyone else, has “passed to the East”… Even among the four boycotters – Saudi Arabia, Bahrain, Egypt, United Arab Emirates – one of the seven Arab emirates, the Emirate of Sharjah, already plans to issue bonds in Yuan and consequently will become the first issuer of the Middle East Market for Chinese Interbank Bonds[15]. It would not be a very good starting point to launch a war against Iran as a prerequisite for the implementation of the Vision 2030 plan[16] originally set up by Prince Ben Salman himself, a plan which positioned Saudi Arabia as a regional power.

Finally, international public opinion will not be easily won over to Saudi Arabia’s support for a direct conflict between Saudi Arabia and Iran. Its reaction to the Qatar boycott provides a clear predecessor.

Our team does not really see how the Arabian Peninsula could resist such siren calls.

The magnet effect of the internationalisation of the Yuan

Let us now look at how the rest of the world gradually becomes convinced by the offer made by the “Other World”.

Africa is in for the introduction of the Yuan as a second reserve and reference currency: Ghana, Nigeria, Mauritius, Zimbabwe, South Africa and Angola have already taken the Yuan into account as one of their reserve currencies[17]: swap agreements, which represent genuine oxygen balloons for economies whose dollar-denominated currencies are too expensive and block exportations[18] (we note of course in this list Nigeria and South Africa, two African political and economic giants).

We may wonder whether the debate currently generating criticism among the Francophone Africa around the relevance of keeping the CFA francs is not related to the fact that the countries linked to this currency administered by France do not have the freedom to turn to similar agreements with China[19], something that is now becoming more and more unbearable.

In Asia, we have seen the defections of Dutertre’s Philippines, knowing that Malaysia and Cambodia[20] are already convinced. Collectively, the ASEAN succeeds in adopting a delicate position of neutrality, guaranteeing independence. As for Japan and South Korea, between the independence-based nationalism[21] of the former and a much less pro-Western regime recently arrived at the head of the latter[22], the conditions are met for a nest explosion, blocked for the moment by the concomitant North-Korean outbursts of provocations; the result is that it has forced the new South Korean government to back down in its plan to suspend the implementation of the US anti-missile shield THAAD and weaken Shinzo Abe[23]‘s military independence agenda. As for Singapore[24] and Taiwan[25], in spite of well-known political disagreements, the economic and financial fields count China as important player.

Nowadays, even Australians are wondering how they will be able to take advantage of the immense opportunities that are naturally offered to them due to their Asian geographical location: “Should we cling very hard to the dangerous borders of a dying empire or should we better seize the opportunities offered by the transition to a multipolar world?”[26]

Of course, there is also India… whose immense border with China and the stormy history of their joint ownership promises great difficulties in the future. But the nuclear balance, the BRICS framework and the bright perspectives of the two Asian giants make a real conflict in the short and medium terms totally unthinkable. The Doklam Plateau crisis and its resolution (which was faster than anticipated by the experts) are proof of this[27], although we must continue to watch closely the Indo-Japanese rapprochement having a strong anti-Chinese component.

As for South America, the countries on the Pacific shore have very strong ties with Asia and China. Brazil, whose involvement in the BRICS was to be questioned with Dilma Roussef’s successor, Michael Temer, is still there … as we had anticipated, “because there is no economic choice “. As for Venezuela, the advent of the Petro-Yuan makes it possible to anticipate major u-turns in this area[28].

As for Europe …

There is Hungary … [29]

… and all the efforts made by the Other World to prevent us from being stuck in the old world: the Chinese Silk Road passing thoroughly on our lands, offers from Iran notably to buy the raw materials we need for our common currency[30], some recent proposals from Hong Kong to integrate the Euro in addition to the US dollar in a basket of currencies on the basis of which the HK dollar would like to renovate its peg[31],…

And on the other side, the Swedish military exercises alongside the United States[32], the increase in NATO participation fees[33], the deployment of US troops on the Russian front, the Turkish crisis.. and the EU’s abysmal political impotence to deal with this dramatic neighbourhood crisis, having failed to complete its project by establishing the political union that had been on the agenda since the 1980s.

Europe is thus closed on itself, physically within its borders, but also in terms of information on the rest of the world, busy as it is, this time rightly, to find ways to take its destiny back into its own hands; Europe is currently focused on its post-Brexit reform, on the forthcoming European elections, in which this time we finally speak of trans-European lists – the only way for a European democracy to emerge and, along with it, the political anchoring of institutions enabling the EU to take strong measures (such as the creation of a European Defence or the linking of the euro to the multipolar monetary system at the end of the year). But the Brexit issue is still hot, 2019 is far away, and the geopolitical swinging deadline is for the end of the year. That said, there are also certain European economic and financial interests …

Multipolar world or Chinese world?

Yet the EU has all it needs to take its right place around the table of the multipolar world proposed by China. As their calls to the EU suggest, as well as their efforts to impose the BRICS logic, the world that China wants to show us is quite multipolar and not simply Chinese.

Best proof was provided in June by the announcement of the New Development Bank (NDB, BRICS bank based in Shanghai) about the issuing bonds in 5 member countries denominated in their own currencies[34].

The stabilised international monetary system that the Chinese have in mind is a multi-currency system, in which different currencies are gold-backed and no longer dollar-backed, the dollar going back to the list of major international currencies.

We have already described this model a long time ago in the GEAB pages. Back in 2009, we spoke of the need for the international monetary system to launch an international currency, the “Global” for example, based on a basket of currencies deriving from several of the major economies (Dollar, Euro, Yen, Pound, Yuan, etc.) in order to strengthen the monetary system actually supporting the world economy, as the dollar alone was no longer able to bear it[35]. The last BRICS Summit has just proposed the launching of a common crypto-currency[36], suggesting that the multi-monetary edifice inaugurated by the advent of the petro-Yuan will be crowned by a global currency … which, very logically, will be a crypto-currency controlled by a multinational public governance system having the BRICS as first stage.

The European Union, having the Euro as dollar’s first competitor, should have played a central role in this process. But just the way it remained for the political union, the EU is stuck in the midstream with its Euro, whilst the Chinese had to make their own way. Meanwhile, the Chinese project will mechanically open up new perspectives for an independent Euro, namely a Euro used in EU’s international transactions, starting with the purchase of its energy. Russia, Iran, Qatar… would obviously have no difficulty if the EU required to have all payments in euros, which would automatically become an international currency instead of a simple back-up currency and a pillar of the dollar system, just like the Yen or the British Pound.

We hold the cards now. Yet we have good reason to doubt the EU’s willingness to look to the future trends and the multipolar world of today. Practically, what information is there available to indicate that China’s new monetary and financial trends have actually been taken into account?

. London, Paris, Frankfurt, Luxembourg … Europe’s financial centres are all located in such a way to try to attract as many activities related to the Yuan as possible, a beauty contest that has been literally doped by Brexit and by the concomitant weakening of the City of London. Useless to reiterate how eager other financial centres are to take advantage of London’s weakening situation[37].

. The last EU-China summit was reinforced with the signature of a Memorandum of Understanding between the European Investment Fund and the Chinese Silk Road Fund committing 500 million Euros of investments in both directions, particularly meant to support the European SMEs[38].

. In 2016, Europe went ahead of the US as a destination for overseas Chinese acquisitions[39].

. Most importantly, on June 13, 2017, The European Central Bank has switched 500 million euros worth of its U.S. dollar reserves to yuan for the first time, thus completing its foreign reserves investment in Chinese renminbi (ECB’s foreign reserves now comprise 62,000 million euros, but also US dollars, Japanese yen, Chinese renminbi, gold and SDRs).

As mentioned earlier in this article, there is something mechanical about the trends described here: the Chinese economic weight naturally changes all figures we have and the interest-based logic knows very well which side to take. Economy and finance still drive the world, that’s a fact. The danger comes from the “systemic” reactions of the stabilising system of the American power (essentially the American-centred military machine) involving both Europeans and Americans. It is true that the US is likely to go through a difficult period with the dethronement of its currency, but the Americans would also have a clear interest in adapting to the new global realities in order to return one day to a prominent position.

The armies of the Almighty Dollar to the rescue of the US indebtedness-financing system

The arrival of the petro-Yuan is of course the end of the dollar as a pillar of the international monetary system and thus the end of the unavoidability of the dollar, a national currency that the vagaries of history have led to support the global economy, which are currently too heavy for it.

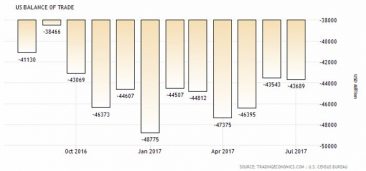

Since there is no longer an obligation to go through the US dollar in international transactions, the perception of the value of the US currency will radically change, to focus more on the reality of the solidity of the US economy , its production, its exportations… so many indicators currently in the red.

Figure 3 – American balance of trade (Aug 2016 – Jul 2017) – Source: US Census Bureau, 2017

The dollar will not disappear at the end of the year, certainly. But it is a matter of trend, and several big countries are going to rush on the petro-Yuans: Russia, Iran, Venezuela to start with, besides China. Practically, the dollar will lose value and trigger a leak out of a dollar-system which everyone knows as based on weak fundamentals. The likely massive return of dollars to the United States will cause inflation[40]. And we are entering the mined territory of the debate on the virtues and/or dangers of inflation on the US’ debt, a debate this article is not intended to enter. We know, though, that it exists and therefore some parts of the US governance system (beginning with the current president) may be in favour of a weaker dollar.

In short, there are those who insist on the perpetuation of the indebtedness system, which allows to continue to finance oneself even if one does not have the means to do so (the army, nurtured by public funds, is probably on this side) and those who are in favour of reducing the debt burden (real economy). If inflation is a means of reducing debt, which satisfies the latter, it also discredits the mechanism of indebtedness which is unsuitable for the former.

Login

Here after, we will try to sketch out the landscape of a series of elections awaiting us until the end of 2017 (in chronological order). Each of these elections reflects [...]

The "peer-to-peer economy" has increased extensively and suffered transformations due to the development of giant commercial players such as Airbnb. The growth of this tourist property-renting website between individuals is [...]

Peer-to-peer economy 0 - Traditional Economy 1 In this GEAB bulletin the article dealing with the Airbnb and similar businesses shows that the "traditional" economy has not yet said its [...]

Comments