We could have also headed our article : “No, the inflating of the Chinese stock exchanges isn’t a bubble”. The Shanghai stock exchange’s exuberant 100% increase in one year is certainly frightening, but it reflects a real dynamic (or rather a correction) of the country’s economic development. One really has to wonder how real money (Chinese savings) invested in real needs (infrastructure, social systems, decontamination, Silk Road…) could create a bubble.

Our team wants to pick up on the inconsistency that there is of being afraid of the financial centres’ gain in value in the obvious economic development zones like China whilst, for years, the whole world must marvel at the Western stock exchanges’ numbers, in particular in the US, in complete contradiction to the economic fundamentals of the areas concerned. Yes, the US stock exchange is in a full bubble (as well as, to a lesser extent, Japan and Europe). But the freeing up of the emerging nations’ dynamics, equipping themselves with infrastructure tools according to the size of their revenue streams, is on the point of absorbing all these bubbles to finance business development on a scale never seen before. The global crash won’t happen therefore because “planet finance” has only just been born.

Sub-parts of this article :

- Chinese stock market : a well-prepared opening

- Silk Road : China has just launched a global New Deal

- The BRIICS and BAII are releasing the power of emerging economies

- From globalization to globality: the plumbing problem has been solved !

- An open but not wide open world

- Towards a Western crash… or not

Our team has decided to make public the part of the Perspectives section named ” From globalization to globality: the plumbing problem has been solved !”

From globalization to globality: the plumbing problem has been solved !

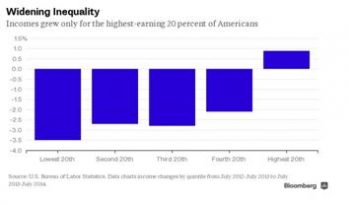

It’s only up to the West to grasp this great opportunity. On one side there is the insurmountable mountain of US problems : an economy which is going into recession once again[1], insecurity which is reaching its highest[2], the poorest 80%’s incomes which have already been falling for the last two years[3], a never-ending drought in California, the spectre of a new government shutdown in November[4] with the possibility of payment default into the bargain, an overheating stock market[5], etc.

Figure 5 – Incomes by quintile, between July 2012-July 2013 and July 2013-July 2014. Source : Bloomberg.

Figure 5 – Incomes by quintile, between July 2012-July 2013 and July 2013-July 2014. Source : Bloomberg.

On the other side, there are the BRIICS’ promising prospects in a rationale of global collaboration.

Our readers well know how worried we were last year over the risk of the West shutting down on itself. Over the last three months we have again picked up the thread of our anticipations over the emergence of a multi-polar world, the challenges laid down by its organization, the obstacles in the way of its implementation and the pitfalls to its development as well. With the Iranian agreement, the world has suddenly become exciting again… because the problems on display are just so many challenges to rise to and no longer death threats. The solutions exist.

These problems are numerous : there is the damage of the global systemic crisis to repair as much as structural problems to resolve together. But the machine has been restarted and for the first time in history it’s global. This passing from a Western to a global world has in the end caused plumbing problems especially : a single currency resting on a small national US economy, financial markets not adapted to the size of money flows, international institutions unable to incorporate the new global realities… Whilst the BRICS have rolled up their sleeves and created the conditions to reinvent a multi-monetary international monetary system, truly global financial markets (through innovations such as connecting their two financial centres of Shanghai and Hong Kong[6], not to mention the Yuan direct settlement network which now spans the globe), multi-polar or global banks like the BRICS bank or the brand-new Asian Infrastructure Investment Bank, to which the European countries, after having frowned at the BRICS Bank, are now rushing at the Chinese invitation (London first, then Paris, Rome and Berlin)[7]… to the extent that the US, after having “scolded” the Europeans for their enthusiasm[8], finds itself obliged to show a certain willingness to cooperate[9].

Even Israel, which has been courted by the AIIB, coincidently during the negotiations with Iran, decided to apply[10].

All this engineering lacked the field of application. The Silk Road provides the first basic outline. The multi-polar world is yet to be built; the trillions floating in the air of the Western financial markets will once again find where to touch down. It’s a true New Deal that the Chinese are offering us, we have seen, but this time it’s global. The West invented globalization but its China, and the BRICS, who have completed the process and put globality in place… To read more, subscribe to the GEAB

—————————————————

[1] Source : Business Insider, 02/04/2015.

[2] According to a 2013 study (already) 80% of Americans have already been an unemployed during their working lives, or for at least a year, have depended on state aid, or have lived on incomes 150% below the poverty line. Source : Associated Press, 28/07/2013.

[3] Source : Bloomberg, 02/04/2015.

[4] Source : CNBC, 16/03/2015.

[5] Source : MarketWatch, 25/03/2015.

[6] Source : China Stock Markets web

[7] Source : Le Monde, 17/03/2015

[8] Source : The Guardian, 13/03/2015

[9] Source : Xinhuanet, 30/03/2015

[10] Source : Japan Times, 02/04/2015