GEAB 120

Dear readers,

Another year is ending. The 12th year for us… and for some of you as GEAB readers.

As it goes with Decembers, it is time to take a break, to ponder the road we have travelled, to question the relevance of pursuing, and to ask ourselves what research orientations to give to this coming year 2018. By the way we invite you to run the same retrospective in your own activity domains…

Our annual evaluation is, of course, central to this reflection: a 75% success rate according to our assessment of the “36 trends of the year 2017” we identified last January; something which comforts us on the accurate view of the “map of the year to come” we put on the table 11 months ago.

All in all:

. Yes, the international and European governance systems have entered the final stages of their huge crises of legitimacy and efficiency, as they registered de-financing shocks and resounding failures such as the recent WTO void result!

. Yes, the world is settling in the brand new geopolitical configurations, and in particular the Middle East, this crossroads of world geopolitics of the second half of the twentieth century; a Middle East which no longer looks like the shapeless mass of countries under Western tutelage as we knew it; a Middle East which got structured around major regional players, seeking to create the best conditions for their regional survival!

. Yes, the decision-making system has returned to the national level and a group of influential countries ruled by more or less autocratic rulers who tried to tune their violins in order to divert the collision courses technocratic systems were dragging us along…; creating risks of tensions of a new kind in the same move.

. Yes, the international monetary system has started a big shift away from the centrality of the dollar and from unconventional money-creation policies

. etc.

We are particularly proud of our real “inspiring moment” when we anticipated a German crisis, knowing that in January 2017, Germany was still the absolute star of the game; to mention also our successful anticipation on the MERCOSUR-Pacific Alliance rapprochement identified in the context of our work on regional integration processes; or our view about Turkey, for which we predicted a beautiful economic curve in 2017.

In addition to the rating of the 36 trends of last January, we wish to add our successful anticipation on oil prices, a success visibly reflected in Alexa’s statistics[1], which places the GEAB among the world’s relevant sources to be consulted on this topic.

This “rewind” also led us to identify some weaknesses regarding Bitcoins, a topic too important to be addressed in a way that may have been relevant but not sufficiently argued to shed the proper light on this major phenomenon of the “world after”. We therefore decided to include in our team blockchain and e-currencies specialists in 2018, who will study, develop and support our anticipations on this matter.

Looking back on this year 2017, one thing is clear: we have now completely switched to the “world after”. Our world will have to face crises of a completely different nature than those we knew in the past years. So far we essentially described and anticipated the collapse shocks of the previous system piece by piece, but we will now have to anticipate the risks related to the immaturity of new players evolving in a new universe in the absence of any common frames.

Concretely, we will continue to observe the collapse of the last parts of the previous system (such as North Korea, where the situation is not yet settled). But we will also focus on all the reorganisation processes and dangers of skidding. Imagination is more than ever required to systematically relate the observation of facts to the new characteristics of interconnectedness and augmented intelligence of our human society in the 20th century, to be able to project realistic futures in our favourite fields: economy-finance, politics and geopolitics.

I will be very happy to have you by our side in 2018. Together we will explore this “world after” which is full of dangers, opportunities and understanding challenges.

The whole GEAB team joins me in wishing you a happy festive season and all the best in 2018.

With warm regards,

Marie-Hélène Caillol, Director of publication

“The Bitcoin Reserve Act 2018”

Our team’s position on Bitcoin has always been based on a feeling of distrust. Though, we admit that digital currencies are clearly part of the future. Our caution comes from the structurally speculative nature of Bitcoin. If this feature makes this “currency” so attractive and turns it into a flagship of the expansion of e-currencies, at the same time, it is its Achilles heel that make us say that one day, more or less brutally, state structures will put an end to this witchcraft.

They have the power to do so, admittedly. China has shut down overnight Bitcoin trading platforms and banned purchase among its citizens, although two-thirds of Bitcoin miners live on its territory. South Korea just followed the example, more or less[2].

Given the bewildering levels of Bitcoin, the lack of slightest reaction from Western states has led us to the conclusion that these states are now part of the game, something which would not be surprising given the combination of their debt levels and their urgent need to stop their monetary easing policies. Could Bitcoin be part of the range of State refinancing means?

Fig.1 – Bitcoin level over the past six months, in US dollars. Source: ABCBourse

After all, if big players start buying, the Bitcoin value will not fail to make this “currency” even more attractive; drawing “small investors” to come in waves, ready to siphon their nest eggs for some promises of huge easy and quick benefits.

Since we keep seeing our governments constantly striving to inject our savings in their big economy (demonetising to convert cash-formed nest eggs into traceable and taxable money; encouraging us through tax or bank incentives to reinvest our money and get rid of our real estate, etc), we cannot help bearing in mind Roosevelt’s Gold Reserve Act. Back in 1934, this famous Act took hold of the American citizens’ gold to finance the New Deal[3]. A “Bitcoinian” mirage could very well serve the same purpose, the way the Euro-Tunnel[4] illusion had allowed to finance the Channel Tunnel to the detriment of small investors who ended up with… nothing!

We will see later in this article that banks are also buying Bitcoin after months of dithering. How could anyone imagine that this category of players would be able to resist the juicy capital gains generated by Bitcoin after all? The problem is that banks will start doing what they know best, namely speculating, manipulating prices, playing fluctuation games, thus contributing to fuel and burst the bubble in end.

Despite all our good intentions to question our bashfulness when it comes to Bitcoin, all we can say is: “Caution! This Bitcoin thing looks like a smoke and mirrors game”.

Nevertheless we will go further in our exploration of this ecosystem in the coming months. In particular, we will try to see if the arrival of large market investors can end other than with their withdrawal and subsequent collapse of the whole thing.

Against all odds

Over the last few weeks, the excitement around the Bitcoin value has probably been inversely proportional to the real knowledge of observers, but also of the many investors who have been “testing” lately this crypto-economy ecosystem or more broadly the system of decentralised transactions.

We are witnessing a real road movie here: at a time when governments prevent the use of Bitcoin on the one hand, or accompany it on the other; as companies continue to launch ICO (Initial Coin Offering) or to imagine new services and products based on the blockchain; as crypto-kitties are making a stir (we’ll come back to this later),… it’s clear that nothing seems to have a grip on the upward vertical of the Bitcoin price. And yet…

The Bitcoin adventure is a peculiar venture, with twists, technical successes, failures, new language elements (which we will progressively describe here), new ideas for optimising human transactions, a growing heterogeneous and very creative community, which exploits and extrapolates the technological structural foundations laid by a certain Satoshi Nakamoto about nine years ago.

In the past nine years, we have moved from a single cryptocurrency, Bitcoin, to a crypto-economy counting today nearly 1358 coexisting cryptocurrencies[5].

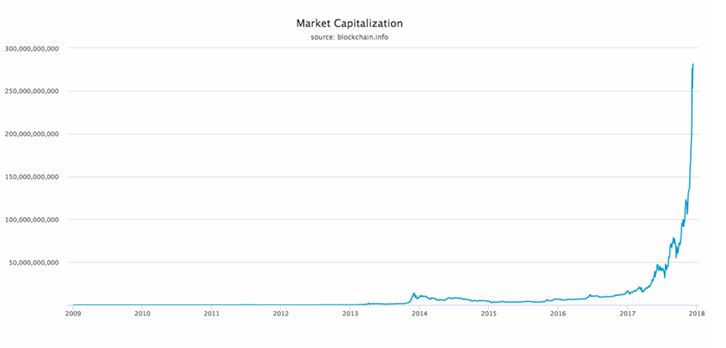

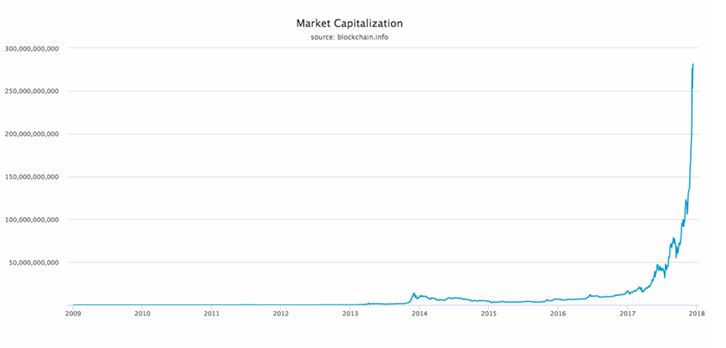

Their global monetary value has gone from 0 to over $500 billion[6]. At the time we write these pages, it amounts to about $280 billion for the BTC Bitcoin only.

Fig.2 – Evolution of the Bitcoin market value. Source: blockchain.info

All the reasons to be wary

The current situation is clearly not healthy. It is not the result of a calm evolution of the course for the simple reason that transactions around Bitcoin have not increased by almost 1000% in just over six months as the value has… Accordingly, we recommend the greatest caution, for several reasons…

Login

We can not help going back to the Middle East this month, simply because what is happening now looks so much like we had been anticipating for several years and [...]

An evaluation of our anticipations for 2017 (drawn from GEAB No 111 of January 2017): 75% successful

Each year in December, we release an assessment of our trend expectations presented last January. This time, we end up with a final score of 27 out of 36, meaning [...]

Bitcoin: in and out Whilst maintaining our recommendation to be extremely cautious on Bitcoin, we suggest to those who wish to test it one simple method: buy an amount of [...]

Comments