Your intelligence for the future

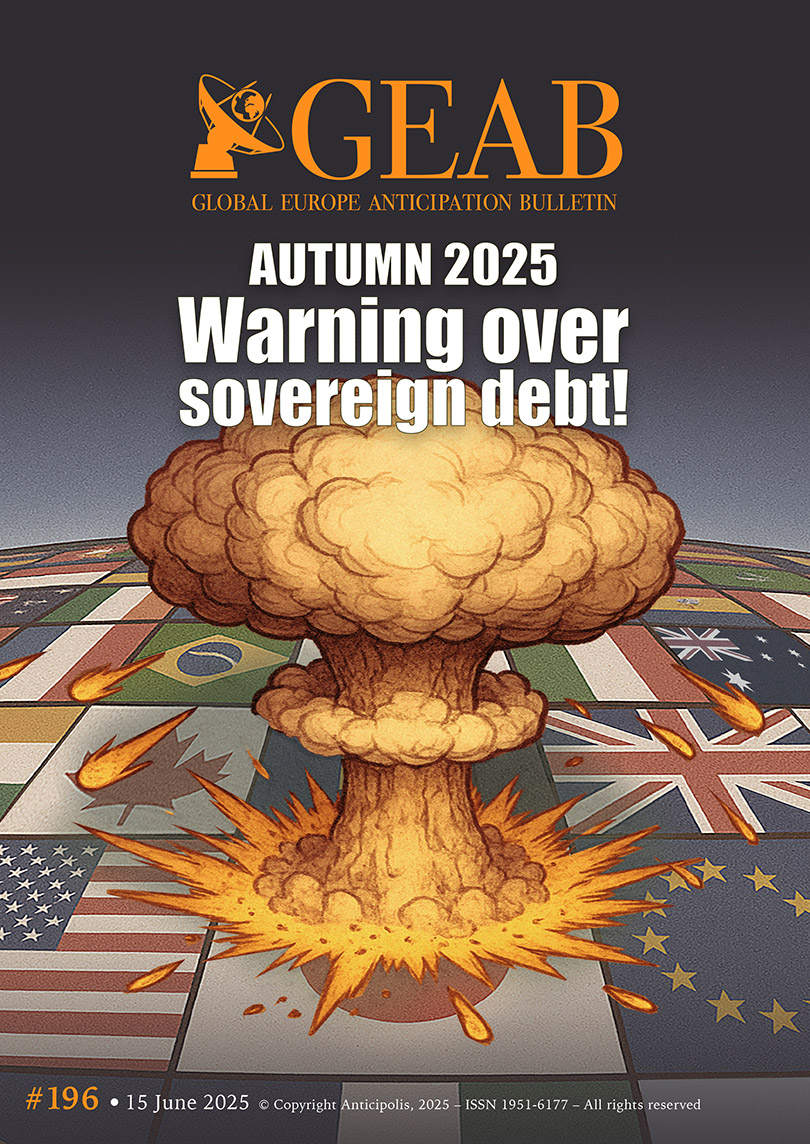

EDITORIAL 80 years ago exactly, the Americans dropped the first atomic bomb on the Japanese city of Hiroshima, thereby ending the Second World War and "annexing" Japan. It is no coincidence that from the far reaches of Japan, a Western empire that pushed the boundaries of power (territorial, military, geopolitical, technological, and financial) to their limits, a major cathartic shock could come in the global systemic transition process that we have been observing for 19 years. The sad date of 6 August 1945, which the Japanese will be celebrating this summer, marks the birth of the American empire. Taking technology developed by the Germans and putting it to military use in Japan, the United States created an empire by establishing a Pax Americana based on its famous "nuclear umbrella". But 80 years on, the empire is notoriously exhausted by the cost of power. The core of the system (the United States, Canada, the Eurozone and Japan) accounts for 68% of the world's public debt and 47% of global GDP. American power rests on a mountain of debt that has been undermining the whole edifice for the last twenty years, despite the appearance of consolidation. Between the first financial shock in [...]