Monetary geopolitics: libra vs e-yuan

The immense stagnation of a eurozone trapped in a crumbling EU has caused many missouts. But two game-changers are shaking the monetary union from its lethargy. We are speaking of:

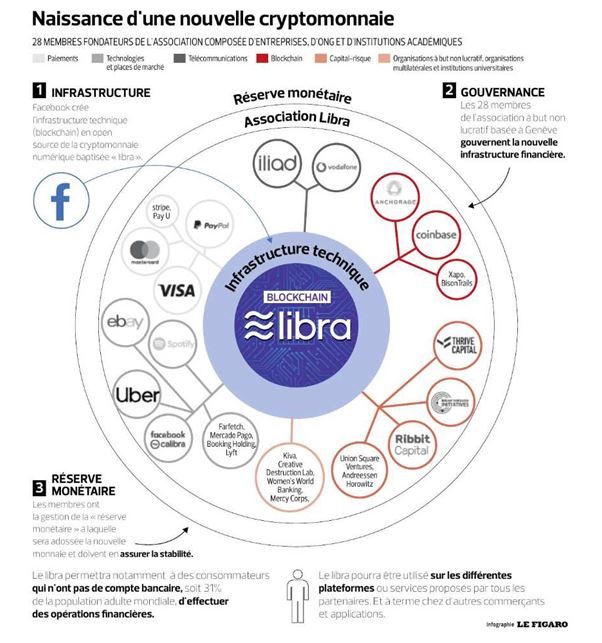

- Facebook’s announcement of the launch of its virtual currency, the libra, which has created panic among state officials and, at least for the time being, has led to a kind of moratorium.[1] However, what Facebook has confirmed via this announcement is that the globalised e-economy can no longer be satisfied with the current monetary system.

- The arrival of the digital yuan, or DC/EP,[2] which was announced in August, shortly after the libra.[3] First scheduled to be launched on 11 November, Singles’ Day,[4] its release is now scheduled for around January-February. No moratorium in sight this time! China is a sovereign state that is free to launch this kind of initiative.

Figure 1 – How Libra works. Source: Le Figaro

While the eurozone, the BIS and the BoE are panicking at these announcements, former Fed Governor Alan Greenspan believes there is no reason for central banks to issue digital currencies.[5] This remark can be attributed to both his age and his nationality (it is first and foremost the hegemony of the dollar that is threatened by CBDCs). However, there is a third analysis to be made of the very logical resistance of Greenspan to digital central bank currencies: The libra is also the new dollar – that is, a global currency issued “from” (instead of “by”) the United States. On the one hand, the Fed would be able to keep its grip on a national dollar that, as we have repeatedly analysed/anticipated, is returning home; on the other hand, the modern versions of American-centric global governance, the GAFAs, are issuing a new currency for international trade.

The polarisation of the models proposed by the libra on the one hand and the e-yuan on the other, would carry within it the seeds of an offensive monetary geopolitics as an evolution of the US-China trade war. Note the symbolic references to a cold war dialectic between the free world (libra) and the communist bloc (yuan instead of rouble this time). In their very structure, these two currencies are in opposition: the libra is a so-called decentralised crypto-currency because it is based on blockchain technology adapted to a liberal model,[6] while e-yuan is a digital currency regulated by the Chinese central bank in line with a socialist economic model.

That said, much is being written about the centralised nature of China’s central bank digital currency,[7] but Xi Jiping has taken everyone by surprise by declaring very recently how good he thought the (decentralised) blockchain would be as a basis for international financial governance.[8] In reality, China distinguishes between centralised national (or supranational, such as the euro) currencies and the decentralised international monetary system it is calling for, each level being considered indispensable and complementary to the other.

In 2020, the libra and the e-yuan enter the markets:

- For the e-yuan, this will be the Chinese market (1.5 billion people) extended to the RCEP market (Regional Comprehensive Economic Partnership representing 2.1 billion more people – or 600 additional millions) which will be signed up by next February)[9] and the major partners of the Silk Road (3 billion people – or 900 million more than RCEP),[10] such as Minor Asia, Europe, Africa…

- On its side, the libra will reach its 2.3 billion users (which explains why it is Facebook that is launching a currency and not Amazon, which has “only” 150 million customer accounts), focused on Europe (286 million users[11]), India (270 million), the United States (190 million), and the emerging countries (Indonesia, Brazil, Mexico, Philippines, Vietnam, Thailand…). [12]

The libra/e-yuan war will be partly territorial because the United States and China will initially exclude one another: no e-yuan in the United States and no libra in China (it is not only because of the intellectual content that China closed itself to GAFA). But, in the first instance, the intermediate zones will be “free” to use both currencies in their international trade in addition to their own local currency. But expansion is the natural impulse of any ethos based on power and money and the “intermediate zones” would soon find themselves crushed by a growing demand to “pick sides”.

Yet, there is another scenario… (read more in the GEAB 139)

________________________________

[1] Source: AISkills, 23/10/2019

[2] Source: BoxMining, 13/11/2019

[3] Source: Bloomberg, 12/08/2019

[4] Chinese Single’s Day is a much bigger version of the American Black Friday Source: The Telegraph, 11/11/2019

[5] Source: NewsMax, 12/11/2019

[6] Source: Forbes, 07/10/2019

[7] Source: etorox, 15/08/2019

[9] Source: Reuters, 03/11/2019

[12] Source: Statista, 07/2019

Comments