The armies of the Almighty Dollar to the rescue of the US indebtedness-financing system

The arrival of the petro-Yuan is of course the end of the dollar as a pillar of the international monetary system and thus the end of the unavoidability of the dollar, a national currency that the vagaries of history have led to support the global economy, which are currently too heavy for it.

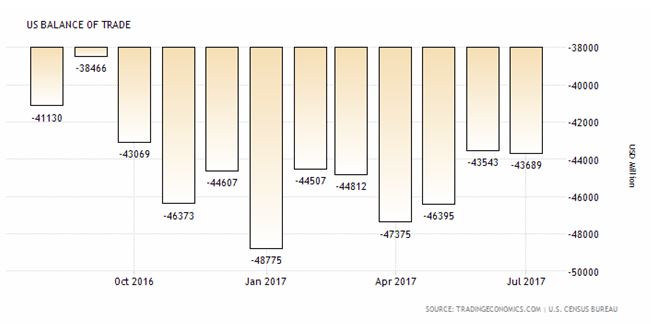

Since there is no longer an obligation to go through the US dollar in international transactions, the perception of the value of the US currency will radically change, to focus more on the reality of the solidity of the US economy , its production, its exportations… so many indicators currently in the red.

Figure – American balance of trade (Aug 2016 – Jul 2017) – Source: US Census Bureau, 2017

The dollar will not disappear at the end of the year, certainly. But it is a matter of trend, and several big countries are going to rush on the petro-Yuans: Russia, Iran, Venezuela to start with, besides China. Practically, the dollar will lose value and trigger a leak out of a dollar-system which everyone knows as based on weak fundamentals. The likely massive return of dollars to the United States will cause inflation[1]. And we are entering the mined territory of the debate on the virtues and/or dangers of inflation on the US’ debt, a debate this article is not intended to enter. We know, though, that it exists and therefore some parts of the US governance system (beginning with the current president) may be in favour of a weaker dollar.

In short, there are those who insist on the perpetuation of the indebtedness system, which allows to continue to finance oneself even if one does not have the means to do so (the army, nurtured by public funds, is probably on this side) and those who are in favour of reducing the debt burden (real economy). If inflation is a means of reducing debt, which satisfies the latter, it also discredits the mechanism of indebtedness which is unsuitable for the former.

As a conclusion, we estimate a continuation of the Cold War between the West and the rest of the world, until 2019 (the year of the next European elections), where the petro-Yans will allow the “Other World” to get organised without the West, in the context of a decoupling between economic and financial systems (probably rallying an open world) and a political system tempted to stay isolated (with movement of goods and capital, but not of people, in a way)…(fragment – GEAB 117 / September 2017)

_________________________________

[1] Since August 2016, US inflation has dramatically increased, from 1 to 2.7 in February (!), but then it fell back to 1.6 in June and continued to rise ever since (1.9 in August). Source: USInflation Calculator, 14/09/2017

Comments