Category: energy

At what expense? And to what end? These are two questions that should arise organically as artificial intelligence technologies are implemented. However, currently, this doesn’t seem to be the case. There is a stark contrast in attitudes among the political and economic leaders overseeing the development and deployment of AI technology. They appear to have […]

The following article is the result of discussions between the GEAB editorial team and Dr Louis Arnoux. The latter’s work is far more alarmist than most research in the same field, namely the future of the oil industry and oil as a fuel for the world economy. The results and data discussed below, even though […]

Article written by Christopher H. CORDEY, Swiss national, founder of Futuratinow, a consulting firm specialising in IDEAtion, strategic anticipation and training. Partner of Yonders.world. Denial, illusion of security, feeling of powerlessness and unpreparedness seem to prevail in terms of preparing the population for the risk of a blackout on a European scale. Blackout is a […]

Commodities – Questioning our certainties // Energy – Market fragmentation // Cryptocurrencies – Counterintuition // Dollar – Transmutation // Real Estate – Attention // Art – “Beauty will save the world” (Dostoyevsky) // Commodities – Questioning our certainties Energy and commodities are already at their highest point and, in our opinion, with no real room […]

Cash, gold, commodities and cryptos – A strong case The above remarks reinforce our recommendations from last March “A short guide for investors in times of reflation/inflation“.[1] A new monetary system will soon be in place where fiat currencies will switch to ultra-fluid “exchange vehicles” such as digital currencies, a real monetary paradigm shift. If […]

To tackle a subject as complex as energy, the LEAP teams called on the collective intelligence of the GEAB, through the GEAB Café of 20 April, and the active participation of Greg de Temmerman and other discreet contributors, whom we warmly thank for assistance. If you wish to also take part in this type of […]

Our universe is an ever-changing web of abundant energy, it is a central aspect of life and all human activity. Yet if we see energy through the lens of our economic activity, it appears as a limited commodity. In this future energy technology timeline, we wish to cast a look at the current energy transition, […]

The post-Covid world is multipolar, with at least three of the major poles competing for mineral resources and industrial production. Until recently, this competition was mainly reserved for the western poles – the United States and Europe. But a third continent has joined those two: Asia. The trend is inexorable. For the past 20 years, […]

Material wealth: give nothing away Tomorrow’s world will be digital, that’s for sure. But not before it has been regulated, organised and controlled. As things stand today, there are too many dangers hanging over this ecosystem – soon to materialise, as we see in this issue – for us to entrust our goods and wealth […]

In a period of uncertainty and with the morose predictions that have constantly plagued it over the last ten years, the European car industry has undoubtedly taken advantage of the covid crisis to take a more wholesome route. In spite of a severe indictment, what with the saturation of urban spaces, environmental problems, unacceptable dangers […]

Commodity markets’ upcoming revolution Growing trade conflicts and de-globalisation within the commodity markets will trigger a rewrite of many COMEX pricing contracts and a resurgence in regional exchanges by 2025. For the last 20 years, the international pricing of key commodities has been driven by the growing market in futures contracts. Today, as many prices […]

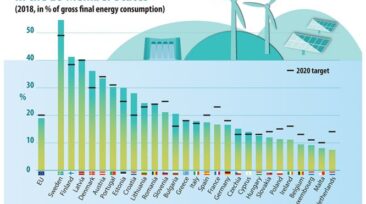

Many renewable energy sources have seen a dramatic increase in both their cost efficiency and their uptake by developed and developing economies. [1] European countries have done particularly well, with some exceeding their 2020 target during 2018. Yet, despite this, such sources can still only provide a small fraction of our total energy requirements and […]

Energy producers, distributors and investors worldwide are currently facing a triple whammy of falling demand, falling capacity and price wars that cannot fail to undermine the international corporate-based energy system that we have all come to rely on. Are countries doomed to repeat the errors of the past, or can the Green Movement work with […]

The manufacture of the future is running at full speed and everyone (individuals, companies, associations, countries, continents) is working on their own (greater or lesser) projects. It is not easy to see clearly what tomorrow will look like in the end. Luckily, the GEAB is here to help you rise above all the hype and […]

Russia’s recent defection to OPEC+ is causing oil prices to plummet and causing the collapse of OPEC, according to the Wall Street Journal. These latest twists and turns in the oil crisis and everything related to it are in line with our anticipations, as for example this one dated June 2018: For the past two […]

As an introduction to our traditional January “key trends”, here are the main guiding lines that we have identified for this “phoney year [1]”. This first year of the new decade promises us a journey through dangerous waters. And the financial crisis announced two years ago by a desperate world of finance could be the […]

Aramco’s IPO: another game-changer Saudi Aramco is a wonderful illustration of the problem that we see beginning to be solved in 2020 with the establishment of a new monetary and financial system – the old one being no longer in line with the global economy of the 21st century. Since 2018, we have regularly heard […]

Crypto-currencies: Gold 2.0? With the greatest caution, playing the diversification and flexibility game to reduce possible risks, we advise you to start investing in the cryptos that now have safe-haven characteristics. Nevertheless, beware when you see things go up or down too quickly and keep a close eye on announcements by the major governments and […]