The future of European private banks

In ten years’ time, if the digital currencies of central banks become widespread, the role of monetary issuance which began to escape from them nearly fifty years ago[1] should come back to them via the recovery of the power of transaction. (“What if, instead, central banks entered a partnership with the private sector—banks and other financial institutions—and said: you interface with the customer, you store their wealth, you offer interest, advice, loans. But when it comes time to transact, we take over”). It is up to private banks to interface with central banks and companies and individuals, to examine cases on the one hand and advise customers on the other.

In addition, customer accounts would be opened directly with the central banks (“an account held directly at the central bank, available to people and firms for retail payments”) and managed online by the customers themselves, as has been happening already for a long time (account tracking, transfers, etc.) as part of a disintermediation of the link between banks of last resort and users (“a digital currency would be a liability of the state, like cash today, not of a private firm”).

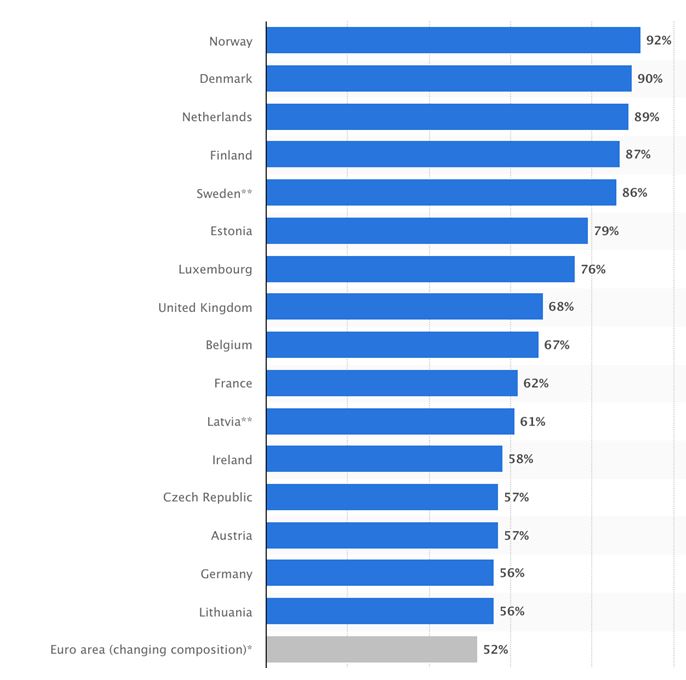

Figure – Online banking penetration rate for several European countries, 2017. Source: Eurostat.

As far as Europe is concerned, the question is obviously whether the bank of last resort is the national bank or the European bank. Given the current mood, we imagine a European level of coordination of monetary policies, a national level of monetary issuance and investors (public and private) networked via a capital markets union and structured around business hubs[2] led by our famous private banks.

As you will have understood, this kind of mechanism would allow state or supra-state structures to partially take the lead in deciding and financing major infrastructure projects that escape financing that is currently irresistibly attracted by quick profits (emerging economies, real estate, one-day start-ups and other bubbles).

On the long road to the digitisation of the international monetary system, the next step is the Osaka G20 summit where the topic of crypto-regulation is on the agenda, of course.[3]

Register to read the full GEAB 136

____________________________________

[1] Currently, more than 90% of the monetary supply is scriptural for less than 10% of currency issuance. Source: Centre national du trading, 18/03/2017

[2] In the sense of financial advice: it is the financial expertise of banks that has value as a service in today’s world where all the technical functions related to the storage of physical money in retail banking have disappeared. However, this expertise must be extended to all new players in the financial system 2.0.

[3] Source: Bitcoin.com, 08/06/2019

Comments