Why this could be the right time to get into silver

Investing in silver is not something that all retail investors will immediately consider. The reasons often given for holding back are the high volatility together with some uncertainty as to which investment model one should follow. Is silver a commodity (often projected to fall in price during economic slow-downs) or a currency more akin to gold (which can act as a safe haven and store of value)? The two asset classes are often approached using different strategies. For this reason, potential investors need to be very clear as to their investment objectives and time-frames.

The very volatility of silver makes it a lucrative tool for the day trader. Short term trends in futures contracts, often led by little more than market sentiment, make silver a suitable tool for high frequency momentum trading. Such speculation based on stock and commodity momentum is however a risky business and not one that we will deal with any further here.

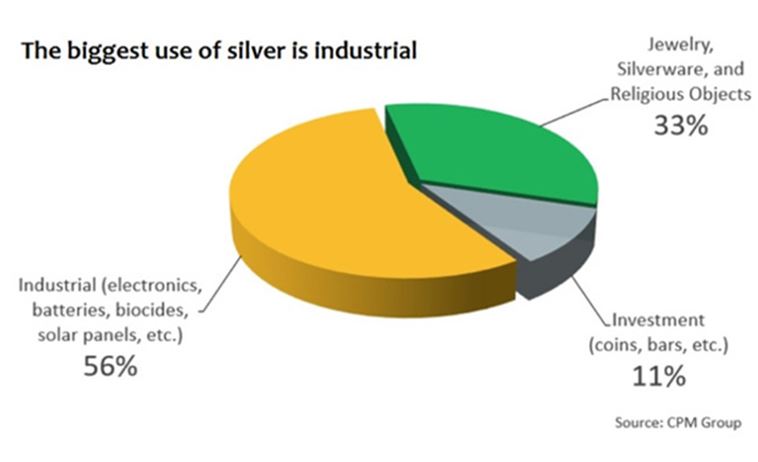

Figure Uses of silver, data from CPM group. Source: sbcgold.com

On the other hand, the long-term utility of silver as both an industrial and monetary metal has attracted renewed interest in recent years. Increasing applications for its high conductivity in electronics, batteries and solar cells, along with a multiplicity of specific highly specialised uses such as photography and nanoparticles, keep it in constant demand…

Login / Register and read more in the GEAB 135 / May 2019

Comments