GEAB 131

What international role does gold play today and do recent market trends and new avenues for investment reaffirm the case for including gold in a balanced portfolio?

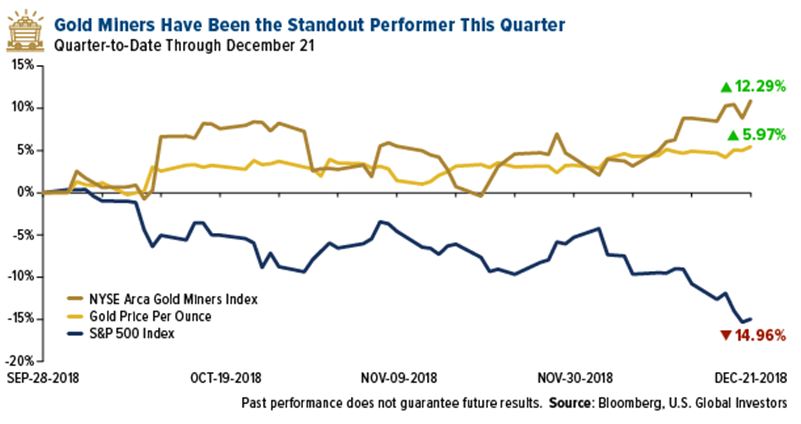

With the holiday season over and stock markets around the world still reeling from a volatile end to 2018, many investors will be wondering where best to store their gains as we enter a storm-threatened 2019. While most major stock indices have taken a prolonged nose dive, gold and gold mining stocks have been two alternative investments that have bucked the recent trend (see figure 1).

Figure 1 – Comparison of gold stocks against S&P500 – Q4 2018. Source: USFunds.com

For many in today’s Bitcoin generation, gold may seem a somewhat quaint and archaic form of investment – a ‘Barbarous Relic’ of older days John Maynard Keynes described it.[1] So why invest in a metal that is no longer used as money and even seems to become less popular in jewellery as the years go by? Perhaps it is time to remind ourselves as to why precious metals have been and remain so important and to look at some of the traditional and newer ways of using them to store our wealth in these uncertain times.

Login

As every year, LEAP is presenting a brief overview of the major ‘up and down’ trends for the coming year. Besides the intellectual value of this contribution, which, of course, [...]

Exactly twenty years ago, in 1999, under the leadership of Franck Biancheri, we launched Project Europe 2020 in Athens – a project to reinvent Europe along the lines of democratisation, [...]

Happy New Black Clouds? The standard wishes for a Happy New Year seem almost out of place for many, given the black clouds that seem to be gathering over the [...]

Bullion and Jewellery For centuries, gold coins and jewellery have been used as small-scale private investments and, for many people today, they remain a good place to start. It must [...]

Comments