Anticipation 2025 : Peak Oil

Everyone agrees that, as announced by the International Energy Agency and OPEC, the next peak oil will be around 2025 (2030 for McKinsey), all sectors of production included, whether conventional or unconventional. After that, the supply will fall or collapse, according to forecasters, in spite of population growth (though we will see later that such growth is a matter for debate) and continued economic growth, thanks primarily accelerated development of the emerging/emerged countries.

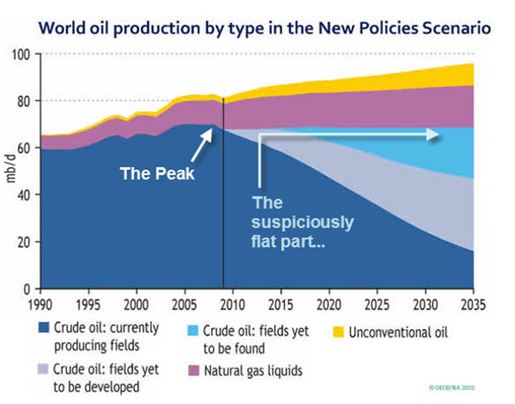

Figure – Scenarios of liquid energy sources in the world up to 2035. Source: Globalchangewatch

The IEA and OPEC differ over the relative importance of conventional and unconventional production. For the IEA, conventional production is bound to continue on its downward slope, but American shale oil will eventually save humankind(!). OPEC, on the other hand, anticipates a shale oil peak in 2025, anticipating no decline in conventional production in the Middle East, which is expected to remain at 40-46% until 2040. Meanwhile, conventional production is expected to account for up to 70% of the global energy market in 2025.

Le rapport sur les Perspectives énergétiques mondiales 2018 de l’AIE – IEA, 2018

World Oil Outlook 2040 – OPEC, 2017

Shale oil boom to peak in 2025, decline from 2030 – OPEC – ICIS News, 07/11/2017

Le rapport McKinsey: Global Energy Perspective 2019 – McKinsey, janvier 2019

Several questions arise: who will win/lose from this peak oil? Exploitation of American shale oil faces several challenges, including the drying up of wells (drought in Texas) and the huge investments required to engage in new prospecting (which is expected to reach more than 75% of capital in 2021). The oil price should not fluctuate too much, especially with the appearance on the market of new players: Canada, Argentina, Russia or China, Mexico and also Africa (Kenya, Nigeria, Angola) producing at lower cost. Hence there is an imbalance in the return on investment, especially for American shale. Will producers be able to keep up? Finally, these projections do not take account of the renewable energies being developed in parallel, especially in China.

Is The Permian Bull Run Coming To An End? – Oil Price, 28/01/2019

L’analyse de Matthieu Auzanneau: « L’essor spectaculaire du pétrole de schiste aux États-Unis apparaît à l’AIE comme la seule planche de salut accessible à une humanité technique plus que jamais shootée à l’or noir, et qui n’est en rien préparée au sevrage. Cette planche de salut semble décidément pourrie. ». Source: Pic pétrolier probable d’ici 2025, selon l’Agence internationale de l’énergie – Le Monde, 04/02/2019

Nigeria: le milliardaire africain Aliko Dangote va construire la plus grande raffinerie de pétrole d’Afrique – African Daily Voice, 10/03/2019

Banque Mondiale, Perspectives économiques mondiales 2019 – Banque mondiale, janvier 2019

This is an excerpt from the GEAB 133. Register to read the bulletin in full

Comments