Emmanuel Macron, the compatible candidate (excerpt – GEAB 115)

The French presidential campaign of 2017 saw a truly historic moment with the televised debate between Marine Le Pen and Emmanuel Macron. The debate revealed two main things: the emptiness of the one’s manifesto on one side and the unexpected density of the character (and programme) of the other on the other side. Our team anticipates that Marine Le Pen will not recover from this debate, nor probably her party, the National Front. The departure of the niece of the Le Pen family is a first confirmation of this anticipation. This is not necessarily good news, because the way will be free for the creation of a new far-right party, more modern and more efficient…

But in this debate, it is not only Marine Le Pen who was bad; Emmanuel Macron was excellent and we owe directly to him the eviction of the far-right candidate in the second round, by succeeding to convince a whole bunch of abstentionists to finally vote for him… for a good reason this time and not as part of a media manipulative affair.

The immense relief the French felt when having avoided Mrs Le Pen, combined with a good dose of media morality and novelty effect, allows the new president to hope for a “relatively” quiet start to his mandate (contrary to what we wrote a month ago – with little conviction we admit). In any case, Macron should not be the subject of the media lynching contrary to what Mr. Hollande suffered from the first days of his quinquennium. And the good economic news that will continue to pour should calm the most recalcitrant ones.

The fact that the programme is a continuation of the existing policy makes it possible to avoid a lack of market confidence, usually accompanied by capital flood, a fall in stock markets, a rise in interest rates, etc. On the contrary, his past as a banker (which in fact exasperates more than a few) and his well assumed pro-business side provides a useful benevolence within the still lurking spectre of the 2008 financial crisis. He is therefore compatible with the markets, undoubtedly.

Figure 1 – French obligations rates, 10-year maturity, May 2016-May 2017. Source: Boursorama.

But also, he is compatible with Europe, more than ever: a convinced European, he does not hide his will to strengthen the European construction. “A strong (and open) France in a protective Europe[1]“; if he succeeds in keeping this promise, it would be the return of an influential and constructive France in Europe, which could suit countries seeking a counterweight to Germany (Germany included, as we often say: no country, and especially not Germany, has the capacity/legitimacy to lead the EU or the euro zone alone, and Germany knows it).

Moreover, he is not representative of the French left wing which displeases so much to other Europeans. On the contrary, his programme is in line with the “left” of other EU states (i.e. social-liberal), with a clear acceptance of globalisation and liberalism. In addition, he comes along as a brilliant man, a man of compromise, who is easy to follow (his meteoric campaign seems to prove it in the eyes of the world), which is necessary for the proper functioning of the institutions of our continent.

Compatible with Germany, finally. Mrs Merkel supported him during the campaign[2], and even the intransigent Mr Schäuble, the current German finance minister, wants to work with him on a euro-zone parliament project[3]. If the SPD wins the German September elections, and although the candidate Schulz has supported Mr Hamon[4] (courtesy between socialist parties oblige), Mr Macron is still compatible, supported by the former president of the SPD, Vice-Chancellor and German Minister of Economy, Mr Gabriel[5] (they also wrote a common article on Europe in the Guardian[6] in 2015). In short, whatever the outcome of the German elections, Mr Macron will be happy to work with Germany, which will certainly not please everyone, but has the advantage of creating the potential for the long-awaited reform of the euro zone

He also promises to reduce the French public deficit (while lowering taxes …), for which he will likely get the approval of the National Assembly. If he succeeds, this should bring him some credibility in Europe and particularly in Germany.

The questions concerning his ability to create a majority in the French Parliament are, according to us, less important than suggested by the media on this subject. On the one hand, in the “democracy” we described at the beginning of this article, opinion-shaping media are more important than opinion-following parliaments, and it is therefore the control of the former that will provide Macron’s real power to implement his programme; on the other hand, the results obtained by the two major parties (PS and LR) in the presidential election are conducive to a cascade of direct or indirect rallies to Emmanuel Macron’s movement. We spoke earlier about a major crisis within the FN, but we must also mention the major crisis that the French power parties are beginning to experience since May 7th.

In fact, the only real opposition Macron will have to reckon with is the radical left of Mr. Mélenchon and his ultra-militant basis, but this opposition will be more visible on the street than in the National Assembly.

Implications for the euro and for Europe

If Merkel remains in power, it is doubtful whether the French president will manage to impose his wish to redistribute wealth within the euro area[7]. Similarly, with Mr Macron, the prospects for a reform of the euro as we described it last month are receding. In reality, the question is less the content of the reform than the policy required to implement it. “Everything is politics” as the protestors of May 68 used to say. And the fact is that a political force, anchored in a supranational economic-media apparatus that manages to take the reins – left free – of the euro zone, is the condition sine qua non for the euro zone to restart working … in one way or another.

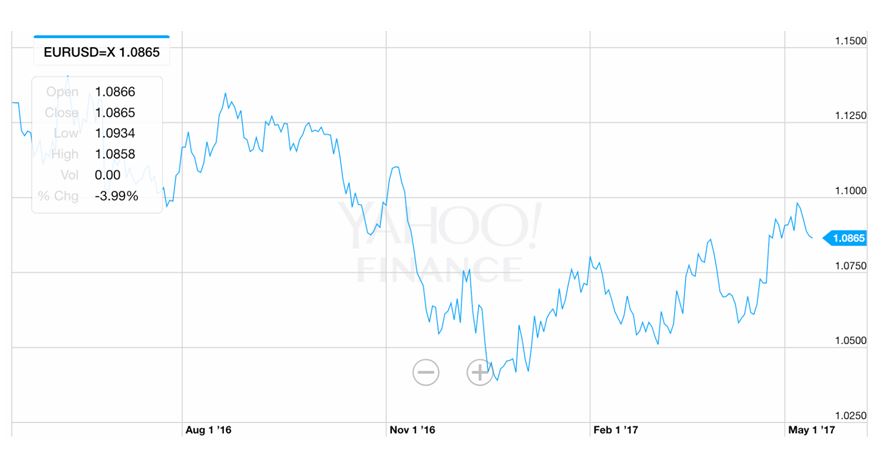

As for the value of the single currency, the good economic news of the euro zone, the possible creation of a euro-zone parliament, as well as the enthusiasm of the markets, etc., will keep it at a good level, only weakened by the QE of the ECB – for as long as the latter will last.

The chances of getting out of the infernal circle of the QE increase considerably with the arrival of a “Eurosystem-compatible” leader in the game. Our team believes that the new president, former banker and former Minister of Economy, will measure the dangers of quantitative easing of the ECB and will push for the adoption of a “fiscal QE” benefiting the real economy, which Mr. Draghi himself promotes and as we have already explained.

Figure 2 – Euro level in dollars, May 2016-May 2017. Source: Yahoo.

Moreover, Mr. Macron’s election, with his liberalism, restores attractiveness to the financial centre of Paris, which, in network with the other stock places of the euro area (and especially Frankfurt), could recover a good part of the transfer to the continent of the financial activity of the post-Brexit City – especially for transactions in euro, it’s obviously more than legitimate to repatriate in the euro zone[8] [9]…

The real positive point for Europe is the return to a constructive dialogue with France through this president who considers himself as a man “without ideology”. According to our team, with the European takeover of the media narrative described above and a perceptible change in mentality after the defeats of Wilders and Le Pen, Mr Macron’s expressed agendas for the democratisation of Europe and European Defence policy[10] will finally be able to move forward, despite the difficulties of these debates[11].

Subscribe to read the GEAB 115 / May 2017

___________________________

[1] Sources: Twitter @EmmanuelMacron (03/05/2017); France24 (03/05/2017).

[2] Sources: Bloomberg (28/04/2017); Deutsche Welle (03/05/2017).

[3] Source: Reuters, 11/05/2017.

[4] Source: EUObserver, 29/03/2017.

[5] Source: EUObserver, 20/03/2017.

[6] Source: Guardian, 03/06/2015.

[7] Source: La Tribune, 02/03/2017.

[8] This is why the Financial Times said in a title: « Macron and Schulz would be bad news for May ». Source: Financial Times, 13/02/2017.

[9] We believe that this project to turn Paris into a major financial centre of the euro zone is probably the one that converged the French financial-economic class around the candidacy of the common foal Emmanuel Macron.

[10] The Brexit could very well simplify things here, too…

[11] Read for instance: « Where might Macron clash with Europe? », EUObserver, 09/05/2017.

Comments