Eurozone: The banking union as a solution

From a budgetary point of view, this compromise can only lead to a kind of status quo. The institutional architecture will stay close to that drafted by the 2011-2013 reforms that were based on unilateral recoveries in competitiveness. All transfers between states will be conditioned and will do nothing to help rebalance the eurozone. They will simply be the reward for unilateral rebalancing efforts. This logic presided over the management of the debt crisis and it is also the one which made it possible to implement the ESM in the wake of the tax pact. The treaties were two faces of same reality – emergency support against structural efforts to reduce debt and, thus, the need for solidarity.

One element, however, can be defining – that of the banking union. France is pushing hard for a breakthrough in June[13] towards the implementation of the banking union; that is, towards the institution of its ‘third pillar’, the pan-European guarantee of cash deposits. Today, the bail-in system set up via the banking crisis resolution process is hampered by the inability of some states to guarantee deposits of less than €100,000. This is why the Commission had to accept public aid for the bailout of the Italian bank Monte Paschi di Siena by Italy back in 2016. Germany refuses to implement this third pillar, believing that the risks of bank failures in the southern sector of the banking union are too high and that such a pan-European guarantee would lead to automatic transfers.

For several months, the ECB and the European Commission have been working to reduce doubtful receivables in the balance sheets of European banks in order to reassure the northern states and move towards the third pillar. In November, Mario Draghi, President of the ECB, supported the German concept of the need for balance sheet consolidation before finalising the banking union.[14]

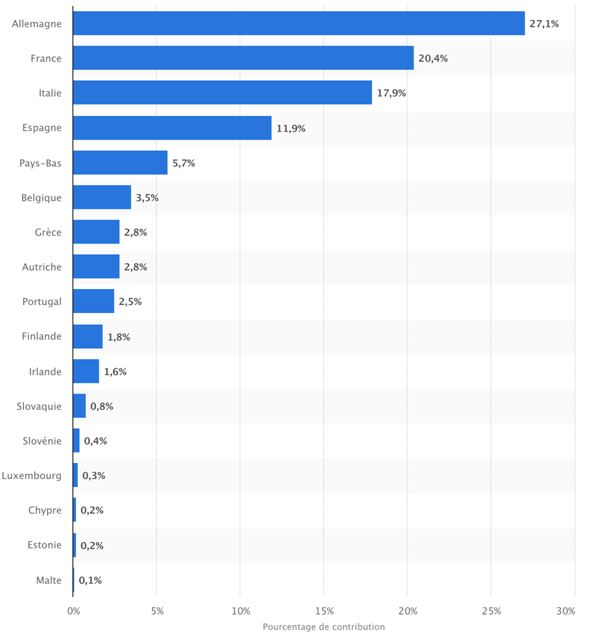

Figure – Countries contribution to the European Solidarity Mechanism (ESM), 2018. Source: Statista.

At the beginning of March, the Commission and the ECB published their recommendations to reduce bad debts on bank balance sheets. Financial institutions will have eight years to raise the needed capital to cover all the debts[15]. This is a message meant for the countries of the north: Bank balance sheets will be cleaned up by 2026 and the third pillar of the banking union can gradually take shape.

This is an important issue. Some observers, such as Financial Times columnist Martin Sandbu[16] and Berkeley University professor Barry Eichengreen[17], argue that fiscal or political union is impossible and detrimental to the European project and that the stability of the eurozone could be ensured by the banking union alone. ‘With a banking union, there is no need for fiscal union’ writes Martin Sandbu. The idea is to completely separate the private risk from public one. If banks can truly solve their crises through a common mechanism with a pan-European guarantee that limits the effect on households, private crises will no longer affect public debt and the financial crises will no longer weaken the euro. This vision has the advantage of also maintaining the national aspect of economic policies in the current framework. As banking union resolution mechanisms limit risk-sharing and are part of intergovernmental decision-making, this path could be favoured by northern states to shape the future of the monetary union. The very slow process of cleaning bank balance sheets allows for a step-by-step progress as well.

Especially for France, progress on the banking union can make up for a compromise on the fiscal union. It would seem, therefore, that federalism through new institutions or the use of ad hoc institutions is no longer on the agenda. We shall see whether such a compromise is sustainable. Dani Rodrik, an economist at Harvard, has insisted that making do with a banking union would be a risk for the euro.[18] In his opinion, ‘it is illusory to think that a crisis of private debt would not be passed on to public debt’. In fact, the banking union’s resolution mechanism, and previously the bad debt cover process, could severely weaken debt distribution. In times of crisis, states cannot stand idle. They should implement automatic stabilizer mechanisms and the most fragile euro members should confront the markets again. The danger is all the more evident as the macro-prudential banking regulation process seems to be slowing down, if not stopping, as was shown by the compromise on the Basel Committee rules last December.[19] Also, United States deregulation should speed up the process in Europe. In the event of a new crisis, the survival of the euro will therefore require new solidarities and, inevitably, more budgetary integration.

In short, the risks weighing on the euro won’t be fully controlled by the banking union alone, while regional disparities will remain high[20] and unilateral adjustment processes struggle to bear fruit in countries like Greece or Italy. The compromise on the monetary union reform will be limited, reflecting the political situation of the eurozone. Yet it is a temporary compromise that cannot preserve the euro on its own…

(fragment: GEAB 124 / 2018)

______________________________

[13] Source: Reuters, 21/03/2018

[14] Source: Reuters, 20/11/2017

[15] Source: Wall Street Journal, 14/03/2018

[16] Source: Financial Times, 25/07/2017

[17] Source: Project Syndicate, 11/09/2017

[18] Source: Project Syndicate, 11/12/2017

[19] Source: The Economist, 07/12/2017

[20] Source: Le Monde, 25/03/2018

Comments