The attack on gold as money

For most of recorded history, gold has been the central sign and store of wealth and the more abundant silver has been the coinage of the people. This continued as the basis for sound money right up until the start of the 20th century. Gold bullion was held as bars by national banks and silver was used in international trade – primarily in the form of 1oz coins.

However, the last hundred years have seen dramatic changes in the way governments have supplied, and people have used, money. Today a fundamental monetary revolution continues, with national currencies, international reserve currencies and new crypto-currencies all vying for their place in the financial system. The American dollar remains the present world reserve currency, having taken over the role from the British pound Sterling after the Breton Woods Agreement of 1944. Subsequently, there was a major crisis in the system, when the dollar de-coupled from gold, and the greenback has been backed ever since by nothing more than the promise of the US government. This situation has been sustained by an artificial demand created by the expectation that all countries would use dollars to trade in oil – the petrodollar agreement that, while increasingly shaky, largely remains in place up to the present day.

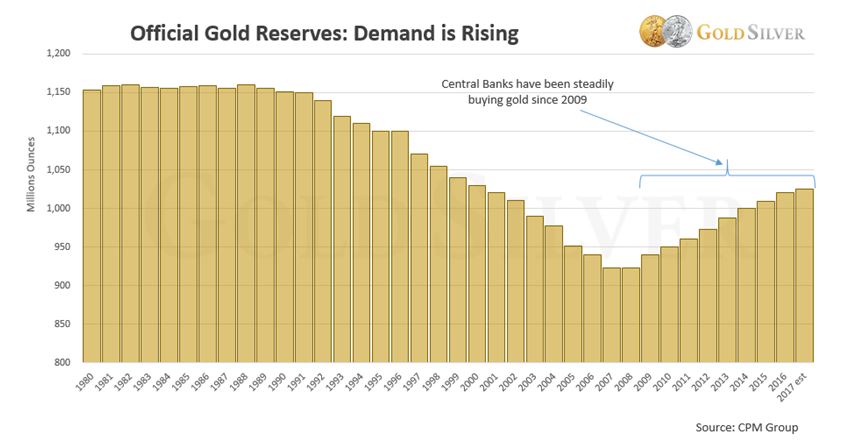

However, as with all fiat currencies, trouble began when promissory bank notes took the place of real assets and central banks were permitted to inflate the supply through fractional reserve banking. While most national currencies had initially promised redemption in gold or silver, this had become increasingly difficult in practice as growing international trade started to impact the amount of reserves held by western governments. Gradually all major governments were forced to drop the gold standard and President Nixon finally ended the exchange system by closing the gold window on 15th August 1971. The subsequent drive by western governments to demote the yellow metal further in the 80s and 90s to just a mere commodity, led to a number reducing their national reserves – sometimes at rock bottom prices.

It was at this time that a lot of the gold started to head to Asia, where its value as a currency reserve was still appreciated. This has meant that, for the last thirty years, gold has been steadily drained from western banks and transferred east; either leased out by London and New York, repatriated to national banks or sold as new physical bullion (recast as 1 kg bars in Switzerland). Hungary, Poland, Russia, China, India, Turkey, and Saudi Arabia are now all actively building up their national reserves[5] and this process has accelerated following the international credit crisis of 2007-9. Figure 2 illustrates the clear change in the trend that followed the financial crisis of 2007/8. Recent estimates have suggested that China has imported and mined huge quantities of gold in recent years, adding to its gold reserves again this January, and holds perhaps far more in reserves than the 1,853 metric tons that they publicly acknowledge.[6]. Investigations into the flows of gold into China have produced estimates that they have accumulated up to 21,000 tons or more, held in both public and private hands.

Figure – Central banks are again turning to gold as a secure asset. Source: GoldSilver.com

GEAB 131 : register and read the full article

Comments