Category: Magazine

RECOMMENDATIONS Invest in Bitcoin Like Donald, invest some of your money in BTC. You’ve been doing it for a long time if you listen to our recommendations. If we are right, with the arrival of a bond and currency implosion, Bitcoin will play its full role as a hedge against inflation. Pay particular attention to […]

SIGNALS Analyses of the techno-social landscape generally promise us a future increasingly influenced by the major technological powers, via their algorithms which today govern life online. This projection is based on the assumption of a linear and indefinite continuity in the evolution of the life of ‘homo numericus‘ over the last ten years. But this […]

REPORT To gain a better understanding of the ideology and visions of the future held by the great apostles of this libertarianism that reigns in the White House, we went to the tenth anniversary celebrations of Liberland, a self-proclaimed libertarian micro-nation seeking to establish itself on the very doorstep of the European Union[1]. “There’s something […]

TREND At the intersection of medicine, technology and economics, GLP-1-based anti-obesity treatments are profoundly reconfiguring our relationship with the body. Behind the promise of a miracle solution lies a society that is literally becoming increasingly ‘disembodied’, guided by virtual standards and industrial interests, at the risk of collectively overturning our eating habits and our humanity. […]

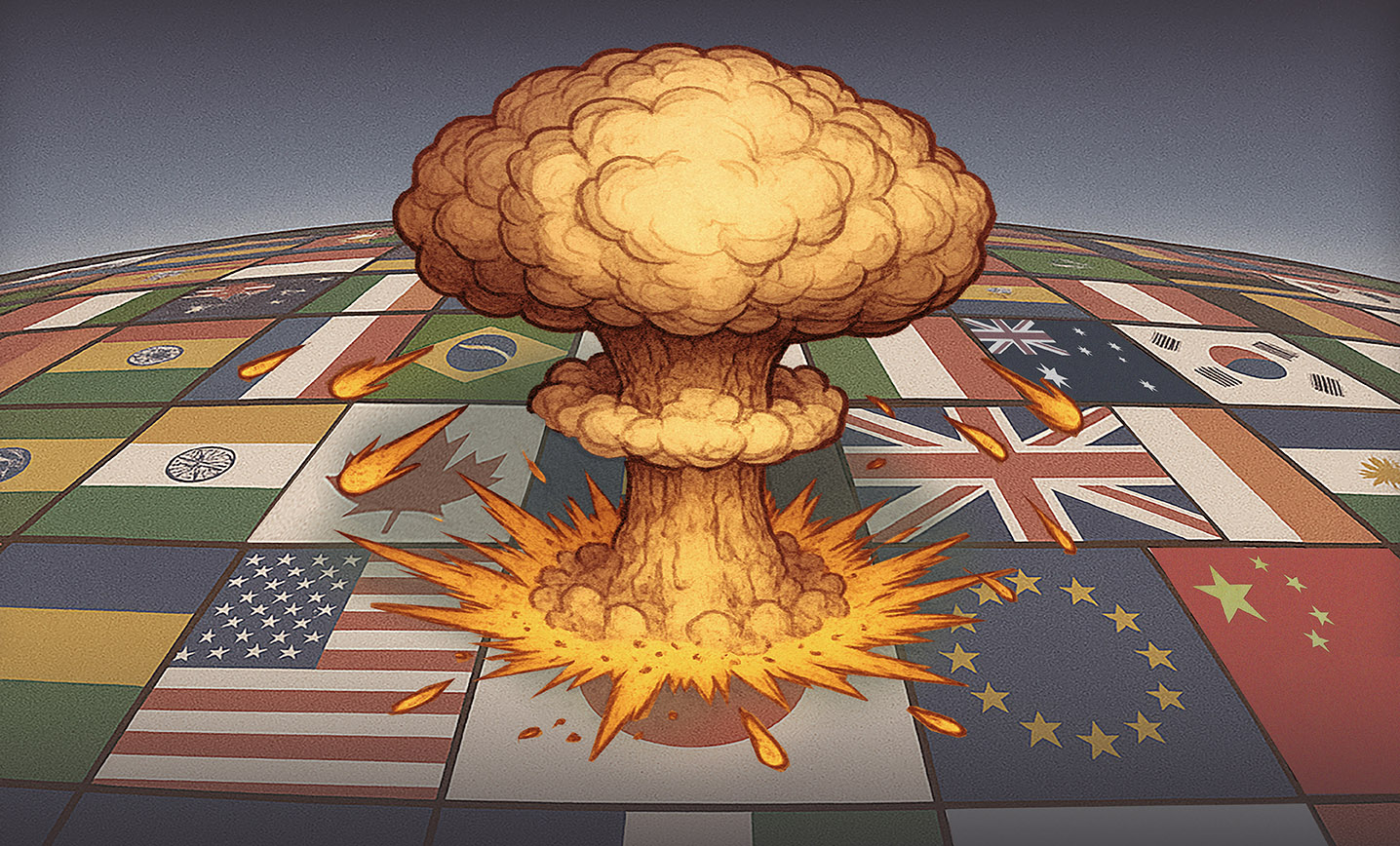

WARNING It’s been a long time since our team issued a warning alert at this level. But many trends are now reaching inflection points that are likely to reinforce themselves in a chain reaction, culminating in a global systemic shock in the autumn. This shock will take the form of a vast sovereign bond crisis, […]

EDITORIAL 80 years ago exactly, the Americans dropped the first atomic bomb on the Japanese city of Hiroshima, thereby ending the Second World War and “annexing” Japan. It is no coincidence that from the far reaches of Japan, a Western empire that pushed the boundaries of power (territorial, military, geopolitical, technological, and financial) to their […]

RECOMMENDATIONS Central theme: as stated last month, the trade tensions created by Donald Trump were indeed negotiating levers. In this context, the UK, China, soon the EU…, are redefining their trade frameworks with the US, customs barriers are being lowered, globalization is being reorganized and financial markets are racing ahead. Gold: The bubble bursts The […]

TREND In a world where capital, goods and people circulate easily, a new axis of competition is emerging between the powers of the multipolar world: that of capturing populations with high purchasing power. The “rich”, along with talent, energy, water, etc., are among the strategic assets we must try to secure. Very low taxes, easy […]

SIGNS While the digital age seems to promise a more integrated, centralized world, we are witnessing a reverse dynamic: a return to feudal logic. Governors, technology barons, federated states and strategic companies are increasingly bypassing centers of power to impose their rules, defend their territories and forge their own alliances. This month, our “Indices column, […]

VIEW An article in the GEAB of March, in the form of a vision rather than an anticipation, suggested a sustainable way out of the current Western crisis by transforming NATO from a transatlantic to a transarctic organization[1]. It’s not often that we judge one of our articles to be of such strategic importance, and […]

VISION The Terra Cognita 2089 section is designed to open up a wider time frame for our anticipations. Based on a critical analysis of the long-term strategic documents (Visions) produced by a growing number of countries and regions, we map out the global future that major world players are in the process of designing. In […]

ANTICIPATION America takes control of the Western Roman Empire. And that’s good news! The United States, no longer defined solely by its WASP[1] identity, stands as the Vatican’s largest financial contributor, providing €13.6 million, or 28.1% of total funding. In contrast, combined European contributions amount to around €7.9 million, or 16.3%[2]. As a result, American […]

EDITORIAL The global systemic transition that we have been relentlessly studying for 19 years has taught us that major crises force us to revisit all of history: Bretons Woods, the end of World War II, the Industrial Age, the divisions of the Reformation, the great discoveries of the 15th century, the great empires… the deeper […]

As in every stock market crisis, stocks will change hands. Insofar as the crisis is largely provoked, it is likely that state structures – starting with the United States – will take advantage of it to regain control of part of the economy. We propose a series of recommendations that take account of three predicates: […]

After almost 20 years of anticipating the collapse of the Western-centric system, the GEAB now feels it has a duty to continue to identify the crises in the making, but also to describe the emerging model. If anticipation is the history of the short- to medium-term future, this article is a sociology exercise of the […]

The dread of the climate crisis could soon be replaced by that of a “global seismic crisis”, i.e. a gradual increase in the number and severity of earthquakes. If we add to this the increase in sinkholes, it would seem that the ground is planning to give way beneath our feet more and more often… […]

At the crossroads of a Russian past, an American present and a European future, Ukraine, which for the last 3 years has been a testing ground for the wars of the 21st century, is on its way to becoming the key to Europe’s next-generation defence architecture, particularly in terms of arms production. The EU at […]

Stock markets are reeling in the wake of Donald Trump’s thunderous announcements. Is the US ruled by an erratic and reckless leader? Or are we witnessing the emancipation of politics from the ‘dictatorship’ of the markets? If it’s the latter, what strategic goals is the President truly pursuing, beyond merely declaring the return of politics […]