GEAB 185

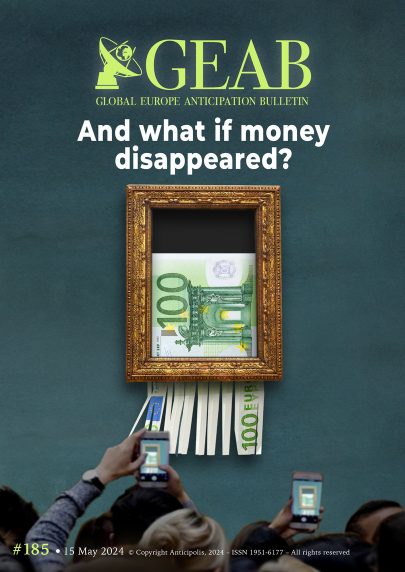

Perhaps this intuition has crossed your mind, or you may have even voiced it, as you increasingly rely on credit cards or smartphones for payments instead of cash. But have you truly pondered it? Our team embarked on this exercise, posing a simple question: What if money disappeared… permanently? Of course, we’re referring to cash. While our societies are far from dispensing with money as a concept—be it as an exchange medium, a safe haven, or a store of value—considering its disappearance prompts intriguing reflections.

The realisation of a complete obsolescence of banknotes and coins would entail profound implications. For individuals residing in stable economies with reliable currencies, the level of trust reached in the use of money is remarkably pure. A mere piece of paper soaked in ink can authenticate a contract or agreement between two parties who may never meet or interact again in their lifetimes. This trust is established collectively, based on the agreement of value assigned to it, initially arbitrary. Moreover, paper money transcends its financial utility to become a cultural symbol, fostering a sense of belonging and engendering minimal intermediation (save for the invisible central bank and the retail bank that fades into the background after issuing the banknote). Consequently, banknotes place the participants in an exchange on equal footing, irrespective of the money’s origin, its previous holders, or its future possessors.

Paradoxically, the use of dematerialised, or even digital, money puts the intermediaries back at the centre: the credit card shows the bank you have used, as well as the colour it has assigned you (blue, gold, black…) and what this implies about your social and economic affiliation. The same goes for your phone: we can see whether you prefer Android or Apple. And there, the feeling of belonging is no longer national but global. The same will be true of central bank digital currencies (CBDCs), which will take advantage of the opportunity to reaffirm their centrality in the monetary system, but the sense of belonging will be more to a currency zone than to a nation.

We anticipate that governments and central banks will soon embrace, if not enforce, Central Bank Digital Currencies (CBDCs) in the coming years. They will do so by leveraging the private sector, particularly banking institutions and now, indispensably, Big Tech companies. This move aims not only to maintain the longstanding public-private duopoly over monetary creation and policy but also to extend economic and, potentially, population control. Moreover, it presents an opportunity to transcend national boundaries, especially in an era where national symbols are fading and information flows freely across borders. These forecasts are articulated in our article titled “The future of payment systems, the disappearance of cash: When monetary policy is no longer enough“.

Was it the United States that pioneered this trend, with its fierce determination to impose its currency beyond its borders? Or was China the first to launch its CBDC? Meanwhile, we have also examined the Euro’s trajectory, situated within a monetary zone rather than a nation or continent. Its challenges in selecting symbols that resonate with all its members have led to the innovation of new approaches. Our article “ Euroland 2025-2030: From reality in our pockets to virtuality, what will remain of the (European) Union” delves into these topics, exploring the implications of abandoning the politisation and citizen federation through a common currency.

Among the developments written in advance is the forthcoming general election in the United Kingdom. And although they were never involved in the euro and are no longer totally involved in the EU, the British are never far behind when it comes to reinventing their relationship with the rest of the world, starting with their European neighbours. And since our era is not immune to paradox, it is through a Europe of nations that Keir Starmer, the next Labour Prime Minister, will renew ties for a “Euro-Britannia 2025: A love Story…”

Amidst the ongoing dematerialization of our daily lives facilitated by digital technology, it’s essential not to overlook another paradox: the increasing demand for metal and mineral raw materials. As our reliance on digital technology grows, so does our need for these resources. China’s significant advancements in this sector place it well ahead of others, prompting us to dedicate a brief focus on the subject in our traditional section “Investments, Trends, and Recommendations”.

Physical artifacts like banknotes may never vanish entirely. In the near future, you might find yourself framing them as art pieces, shredding them based on your mood, or even combining both actions in a Banksy-inspired creation. However, it’s crucial to prepare for the next phase of digitalisation, which will undoubtedly introduce its own set of disruptions, consolidations, and, most notably, paradoxes.

To read the articles of this Issue, subscribe here.

Among the anticipated back to basics, few measures hold as much potential efficacy as money itself. In times of mounting difficulties and risks, reverting to fundamental principles becomes imperative. Politicians [...]

The Euro in your pocket: A sense of belonging to Europe The relationship we have with money is charged with affectivity and emotion, extending beyond its economic, financial, and monetary [...]

Or rather "love at first sight". It may have escaped the attention of our readers, who tend to be more forward-thinking than the average citizens, that the United Kingdom is [...]

CBDC, critical materials, digital industries, green energies, electric cars... China leads the way The transition to CBDCs adds another layer of digitalisation, and will put further strain on markets under [...]

Comments