GEAB 185

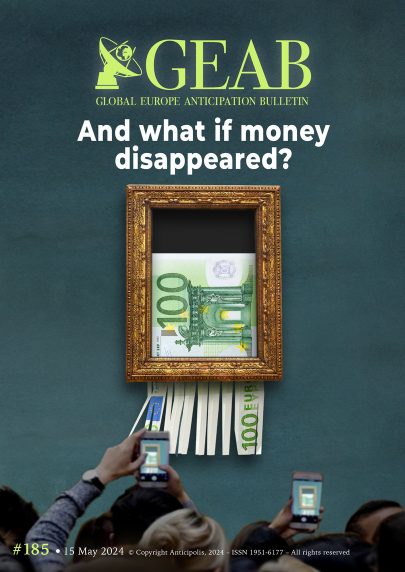

Among the anticipated back to basics, few measures hold as much potential efficacy as money itself. In times of mounting difficulties and risks, reverting to fundamental principles becomes imperative. Politicians are already taking heed of this necessity by doubling down on bold and assertive monetary policies. This is obvious in ongoing debates surrounding central bank interest rates, interventions to stabilise currency values, and shifts in foreign exchange reserves. However, what’s becoming increasingly apparent is the diminishing effectiveness of such interventions.

We therefore anticipate that governments and central banks will be forced to make even more radical decisions. With digitalisation sweeping away everything in its path, it is now the turn of cash to disappear, a victim of central banks’ digital currencies and instant payment applications. Digital currencies will allow a mix of historical approaches, with a return to physical collateral, and more recent approaches, with a return to QE (quantitative easing). All the same, this changeover will see the emergence of a new pact in the duopoly between the private banking sector and central banks, and above all will confirm the presence of Big Tech in the global monetary system. This shift towards digitalisation presents an opportunity to redefine the balance of power among the world’s most influential currencies.

Login

Perhaps this intuition has crossed your mind, or you may have even voiced it, as you increasingly rely on credit cards or smartphones for payments instead of cash. But have [...]

The Euro in your pocket: A sense of belonging to Europe The relationship we have with money is charged with affectivity and emotion, extending beyond its economic, financial, and monetary [...]

Or rather "love at first sight". It may have escaped the attention of our readers, who tend to be more forward-thinking than the average citizens, that the United Kingdom is [...]

CBDC, critical materials, digital industries, green energies, electric cars... China leads the way The transition to CBDCs adds another layer of digitalisation, and will put further strain on markets under [...]

Comments