Your intelligence for the future

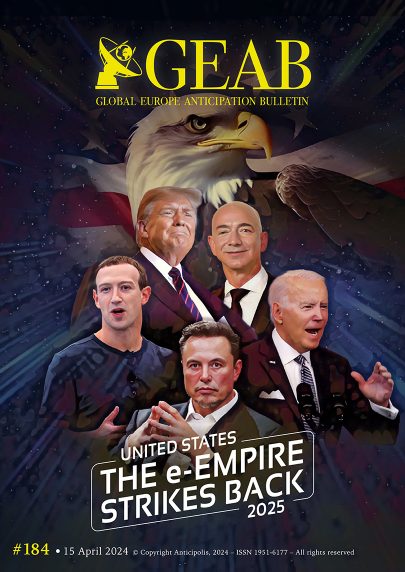

© Kerozen Concept (AI generated image) In a world where upheavals are occurring with increasing frequency, it's easy to value the constants. The American presidential elections are always a thrilling soap opera. The motherland of Hollywood knows how to captivate the attention of the rest of the world, and this season is no exception. With the traditional rhythm of alternating between Republicans and Democrats disrupted, the stakes are up again and the suspense reaches its peak, except that in every good show lies an illusion, in this case it’s the illusion of choice. For those who still hold onto belief, fear not! While the present has caught up with the future, making science fiction classics an occasionally disturbing reality, there's no danger of disappointment. Surprises will continue to abound. Spoiler alert! This regular rotation was a vital characteristic of the United States' status as a global leader, which has largely eroded over the past two terms. Our team is now anticipating the American response to the multipolar world. This is it, the empire strikes back. This counterattack has started and has even proved its worth, gradually spreading over the two terms of Trump and Biden, so that there is unanimous support for [...]