GEAB 165

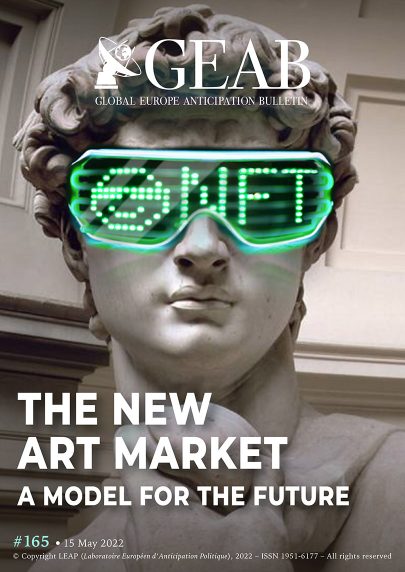

The art market has been adapting incredibly fast to the shock of 2020. The investments are flourishing in this sector, whether the macroeconomic situation is good or bad, which leads us to anticipate that there is a bright future ahead. Its ability to adapt makes the art market a particularly resilient space, responding rapidly to multiple global dynamics like digitalisation, generational transition, democratization, as well as the increase in the number of large fortunes and the world’s multipolarisation. Its accessibility to new players is obvious now. All those trends above have had an impact on the market, which seems to have little difficulty in responding to them as well as entering the world-after. Art will be soon within everyone’s reach.

Login

This issue 165 is an important step in the history of the GEAB as it breaks with the sacrosanct tradition of anonymity of the articles, until now always collectively signed [...]

All the conditions are in place for the shift towards a new world monetary order. The terrible geopolitical and strategic circumstances resulting from the war in Ukraine are completing the [...]

Congress is an important part of a well-oiled political system, and many of its features (like the support for America's endless wars) are bi-partisan or uniparty. But the DC system [...]

Financial markets: Back to reality // Cryptos: Seizing opportunities // Art Market: Options for all types of buyers // Lithium: Mining and processing, two different investments // ______________________ Financial markets: [...]

Comments