GEAB 113

Without Kissinger to negotiate the petrodollar and put the US currency back to the centre of the global game after the shock of Nixon’s announcement in 1971 to halt the convertibility of the dollar to gold, the greenback would never have been the world benchmark since more than 40 years. Will Trump really know how to surround himself with advisers of the same calibre? Also, will he take their advice? Because a shock of the same magnitude is currently in gestation: it is called ‘payment default’ of the US public debt. It is the taboo which was lifted by the election of Trump. So, will it be a self-fulfilling prophecy or healthy debate? A solution or a total disaster?

The unthinkable sovereign default

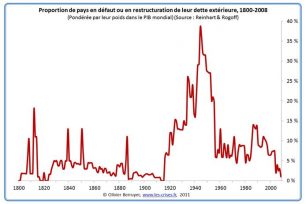

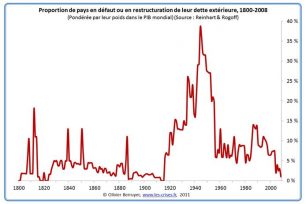

If there is a country on this planet banned from defaulting on its public debt, it is definitely the United States. US Treasuries are at the heart of the global financial system, considered the ultimate safe haven and the most liquid bond market in the world. It goes without saying that no one expects the United States to miss the slightest reimbursement of its sovereign obligations. The deflagration that such a default would produce seems, apparently, incomparable with that of the Lehman Brothers bankruptcy, if we refer to the amounts at stake ($600 billion for Lehman, against $20 trillion of US public debt) and to the systemic place Wall Street takes, and more generally the finance on the other side of the Atlantic. The United States, if it wants to hold its rank in the present world order, is clearly deprived of this option, quite common for other countries nevertheless (for your information, over the last 35 years we can count no less than 70 sovereign defaults in the world[1]…).

Figure 1 – Global public debt in default or under restructuring, as a fraction of the global GDP, 1800-2008. Source: Les Crises.

But the United States has never failed in its federal debt. This is undoubtedly a safe bet and so a US sovereign default is really unthinkable. Unthinkable, right? Just like Brexit or the election of Donald Trump!

The certainty crumbles

For the record, the US Federal State has never failed before. And yet … How could one qualify the 1971’s convertibility of the dollar to gold stopping[2], resulting in a major dollar value loss compared to the precious metal, and along with it the North American debt? Or maybe the similar devaluations of 1933 and 1934 under F. Roosevelt[3]? As we can see, this does not necessarily take the form of a clear non-payment… And since we talk about Roosevelt, does Trump’s “programme”, consisting of an economic revival via infrastructure, not vaguely make us think of the New Deal[4], creating a priori the same temptation to strongly devalue the greenback[5]?

This could be risky speculation if Trump had not himself displayed during his campaign his willingness to renegotiate the US public debt if necessary[6]. Careful though, we do not pretend that the newly elected Trump is doing what he wants on this matter (or on any other, moreover), quite the contrary: he is undoubtedly instrumental on many points of his policy. Nevertheless, the taboo is lifted[7] and it is no longer inconceivable that the United States will, some day, record a default (in one form or another) on its federal public debt, which is already changing everything in the way people think.

Our analyses on this topic in the GEAB, which started many years ago, now take their full meaning[8]…

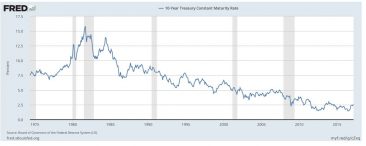

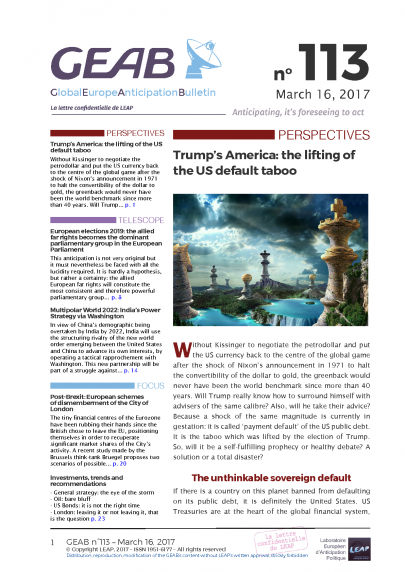

Writing off the debt

What this change in perspective on US debt brings is well summed up by Trump’s phrase: « I would borrow, knowing that if the economy crashed, you could make a deal. And if the economy was good, it was good. So therefore, you can’t lose. »[9]. To be honest, it is difficult not to give him credit for common sense: he would do wrong to deprive himself of borrowing on the markets[10], given that the country can do so at historically low rates. Moreover, we are speaking of the United States, and not Argentina or Greece, and markets would soon forget a US default and lend again to the new economic prospects of this country, (re-)opened by this restructuring. The painful period seems thus reduced to the few months preceding and following the default.

Figure 2 – US 10-year treasury maturity rate, 1975-2017. Source: FRED.

The lifting of this taboo has as first consequence the debunking of the US public debt, which will indeed be necessary if Donald Trump wants, as he promised, to reduce taxes whilst carrying out his plan to support the US economy … There is definitely no question of default right now as the conditions have never been more favourable to borrowings. The official forecasts, which we find very optimistic, show a public deficit growing up to 5% of the GDP over the next ten years.

Figure 3 – Deficits (or surplus) over the next decade in the US, as a share of the GDP, 2000-2027.

Source: New York Times.

We anticipate that the lifting of the default taboo will lead the US to borrow even more than what the current projections claim. According to the growth which the country will be able to generate[11], the public debt should thus increase from its present value of 105% of the GDP to probably 115% to 125% under this first mandate of Trump (see the detail of our calculation in the box below); a sharp increase in just four years. And again, without counting the 17% debt of the local States and governments. In view of the current standards, these are not levels which could automatically lead to bankruptcy, but it is a trajectory hardly sustainable in the long run[12].

Here are the details of a very rudimentary calculation confirming this increase: if Trump achieves the growth target of 4% per year (which we strongly doubt), the GDP of the United States in four years will be of about $22 trillion. But for this to happen, the US will have spent $100 billion per year in its infrastructure plan, and will have lowered taxes by 30% for individuals (Trump’s promise was a drop of 30 – 35%, source: FactCheck, 04/11/2016) and by 50% for businesses (going from a tax rate of 35% to 15%, source: The Atlantic, 23/01/2017); resulting in a shortfall of approximately $620 billion (source: Tax Policy Center). Compared to the current deficit of about $600 billion, the new deficit would therefore be around $1300 billion. Add to this an average debt interest rate which could rise by at least 1%, meaning an additional expenditure of about $200 billion. Overall, the debt in four years would be around $26 trillion, or 118% of the optimistic GDP value at that time. We assume here that the cuts which will undoubtedly be made in the social security budget, will be cancelled out by a military budget increase.

Login

This anticipation is not very original but it must nevertheless be faced with all the lucidity required. It is hardly a hypothesis, but rather a certainty: the allied European far [...]

In view of China's demographic being overtaken by India by 2022, India will use the structuring rivalry of the new world order emerging between the United States and China to [...]

The tiny financial centres of the Eurozone have been rubbing their hands since the British chose to leave the EU, positioning themselves in order to recuperate significant market shares of [...]

General strategy: the eye of the storm Like we started warning in our last GEAB issue, the utmost caution is still required these days. The appearance of recovery, here and [...]

Comments