GEAB 136

Reports are currently proliferating concerning the health of the European banking sector ten years after its great crisis.[1] However, on the one hand, the European banks only managed to get out of it with public funds;[2] on the other, some behemoths are still seen as ticking time bombs[3] (Deutsche Bank, Commerzbank,[4] Monte Paschi[5]…). Finally, the European banking system is struggling to finance the needs of the continent.[6] The balance sheet of the European banking recovery is mediocre at best: supported at arm’s length by public authorities, and certainly cleaned up thanks to the Basel regulations, but at the expense of efficient financing. Are the private banks, invented in Italy at Quattrocento, still the most relevant players to finance the European economy of the 21st century?

The organisation of the European financing system: towards an Anglo-Saxon model

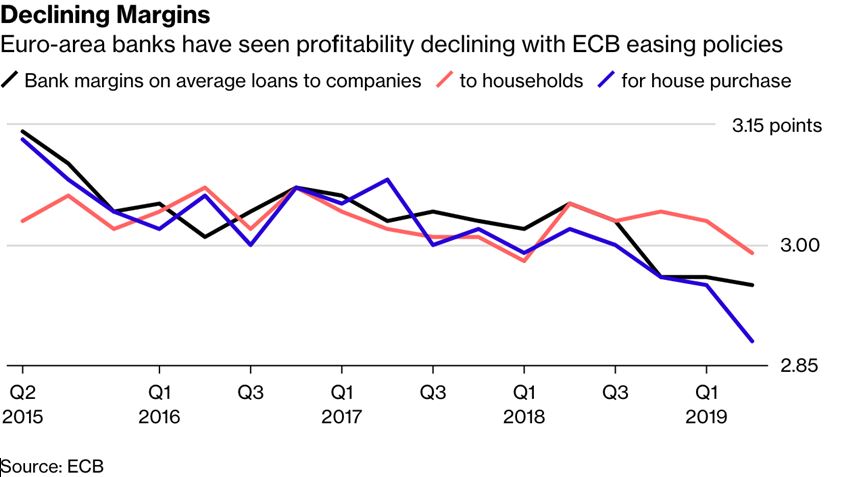

The transformation process is already underway and the pressure that European banks have been under over the past ten years has been immense and multidirectional. The very high operating costs of the ECB’s low, and even negative, interest rates[7] have weighed heavily on the sector, forcing it to reduce costs by all means possible, including reducing staff and branches.[8] Despite this, their margins have only shrunk in the face of the rising costs of cybercrime and cyber-security.[9] To make up for the concomitant reduction in their margins, the banks are trying to invent operating costs,[10] but the competition is fierce since the emergence of new online ultra-light fee banks.[11] No wonder, then, that traditional banks are investing, still at great expense, in online versions of their systems[12] – with partial success.[13] The Basel regulations, on the other hand, force traditional banks to be cautious about their ability to lend[14] and this is a constraint that obviously weighs – or has weighed – much more heavily on the old banks, who had to clean their accounts, than on the new ones directly created on this legal basis.

Figure 1 – Profitability rate of European banks, 2015-2019. Source: Bloomberg/BCE.

Nevertheless, the European banking system has survived this squeeze (there was obviously no question of it exploding; hence the importance of aid, buybacks and public guarantees throughout this period), but it probably hasn’t reached the end of its efforts to adjust either.

Indeed, since 2015, among the approaches mentioned in the context of reflections on the reform of the eurozone (banking union, Eurobonds, budget, government…), talks have centred around a Capital Markets Union,[15] i.e. a system that facilitates cross-border investments in the eurozone (or EU).

In terms of the reform of the eurozone, we know that France and the Netherlands have fiercely opposed these solutions. They have even led a whole camp (the famous Hanseatic League) against the French proposals for a government of the zone, deemed centralist.[16] The fact is that the increasingly widespread dislike among Europeans for anything that resembles a centralised Europe has made the position of the Netherlands particularly relevant.

Hence, there is no government of the eurozone for the moment, but an urgent need to complete the common monetary zone by rebuilding it with a strengthened capacity to finance the eurozone economies. As we have already pointed out, Salvini’s provocations are undeniably justified by the idea that the constraints of belonging to the eurozone are acceptable only to the extent that each member country gains a financing capacity greater than the one it would benefit from if it were alone. Excellent point!

The implementation of the mini-BOTS project of those currently leading the League/5-Star coalition in Italy[17] (a sort of mini-security likely to become a new means of domestic payment) has all it takes to shake up the masters of the euroland game. Moreover, as if by chance and almost simultaneously, the Germans, the French and the Dutch are finally coming to an agreement on the launch of the “Capital Markets Union” solution,[18] with the famous Eurobonds that, until now, Germany has repeatedly refused.[19]

Admittedly, just as one swallow doesn’t make a summer, these three countries do not make up the whole eurozone. As we have previously discussed, the concept of the Franco-German machine, 70 years after the Treaty of Rome and in a Europe of 19-28 countries, is an anachronism which needs to evolve towards that of an ad hoc “Europe of enhanced cooperation”. The ad hoc alliance of these three countries in favour of this means of completion of the eurozone doesn’t make it possible to bet with certainty on the launch of the CMU, but it does significantly increase the chances – and especially the imminence of its advent – if only because, contrary to the approaches of government, particularly in terms of taxation, the agreement of all the countries is not required. Even better, these three countries have no reason not to open a first capital space between themselves to start with, as suggested by the Financial Times, which knows what it is talking about[20]…

Login

Under the impetuous blows of the global systemic crisis, the automatic pilot system (technocracy), that determined our direction and cruising speed until 2008, is gradually coming to an end. The [...]

The ongoing trade war between the US and China has recently taken a new turn with the involvement of the digital giants, under obvious pressure from the White House. Alleging [...]

Interview with Eric Leandri, CEO of Qwant CEO and co-founder of the French search engine Qwant, Éric Leandri shares with GEAB readers his conviction that the US-China trade war offers [...]

We are now well into the fifth – and probably last – wave of the oil era. All the conditions needed for us to leave behind our oil dependency are [...]

Crypto-currencies: Gold 2.0? With the greatest caution, playing the diversification and flexibility game to reduce possible risks, we advise you to start investing in the cryptos that now have safe-haven [...]

Comments