GEAB 143

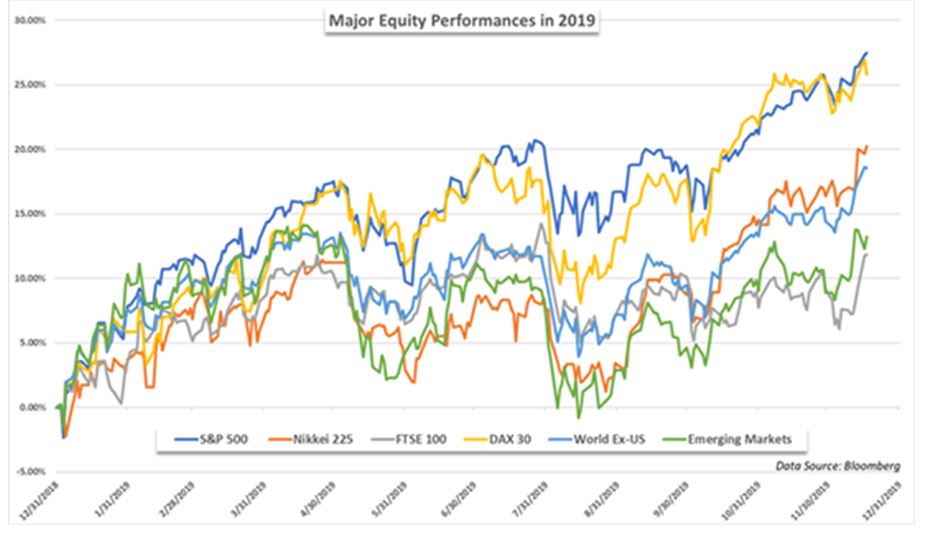

2019 was a bumper year for US stocks and, while much of Europe and the Far East faced tougher growth conditions brought on by more local concerns (Brexit, Hong-Kong etc.), full steam ahead was the order of the day. As the year reached an end, dollars continued to flood home and indirect stimulus through the repurchasing (repo) markets pushed stock indices, including the Dow, to all time highs by December (See figure 1) and on into February.[1] The bear market of autumn 2018 was long forgotten as the S&P500 saw an annual return of 29% year on year and bonds remained strong too – though with low yields. While the usual contrarians raised fears concerning high price-to-earnings ratios, overleveraging, stock buybacks and continued central bank stimulus, no one could have foreseen the storm brewing in a fresh meat market in Wuhan.[2] For all that it has had minimal direct impact on the financial markets, the spread of the new coronavirus (SARS-CoV-2) has provided a pin that could prick the largest credit bubble in world history.

Figure 1 – Major stock performances in 2019. Source: a.c-dn.net

Login

Reduced mobility, the tourism crisis, the green economy, dematerialisation of the economy, Euroland, digitalisation of central bank currencies, a radical reform of the international financial system, disruption of the European [...]

Wars have undoubtedly generated plagues. But do plagues generate wars? From a systemic point of view, the pandemic should be enough to seal the fate of the old system, inaugurate [...]

Markets/financial products - Do we really need to mention this? You don't need our insight to realise this, but for the sake of clarity: it's time to stay away from [...]

Comments