GEAB 143

Reduced mobility,[1] the tourism crisis,[2] the green economy,[3] dematerialisation of the economy,[4] Euroland,[5] digitalisation of central bank currencies,[6] a radical reform of the international financial system, disruption of the European banking system,[7] the end of liberalism, a paradigm shift and, even, our anticipation of a stabilisation phase in 2020[8]… As we entered this new decade, we had to ask ourselves what the catalyst would be for all the upheavals that we had anticipated would occur in 2020.

We did not have to wait long to see that a “pandemic fear”[9] will establish the global systemic transition. Mr. Taleb’s “black swans” don’t matter[10] after all: when a system has to break down, it breaks down… It’s the good old rule of the last straw that breaks the camel’s back… and that’s what we call the “black swans” in the Manual of Political Anticipation: “last straw events”.[11]

The challenge in such circumstances is to think straight, maintaining as much objectivity as possible in trying to discern what will ultimately emerge from the general panic. Of course, this depends on the scale and severity of the pandemic, but we are terribly tempted to simply go back to our vision of what we have been calling “the world after” for the past 14 years and which we have good reason to envisage being set in place via the immense transition shock sent from China. Three arguments militate in favour of the fact that the world will not return to the ex-ante situation at the end of the crisis:

- Some leaders were “just waiting for it”: We reiterated last year that the “financial crisis of 2020” as anticipated for the last 2 years would not happen because, unlike the one in 2008, it was perfectly anticipated. For 12 years, the world (Chinese and European in particular) has been preparing to replace the current dysfunctional financial system and was waiting for the right moment to do so. But it is not only money, finance and banks that will be transformed by the crisis, other transformational projects will be able to unfold, as we will try to illustrate in this article.[12]

- Habits will be created during the crisis: The crisis situation is set to last,[13] imposing a long-lasting panoply of precautionary measures, ranging from working from home to the closure of borders. At a slower pace, the economy will reorganise itself in order to operate under these new conditions and new habits will be created, some of which will take root for a long time. For example, we anticipate a reorganisation of supply chains towards more sustainable models.

- An organisation is being set up to avoid further pandemics: The anticipation of other crises of the same type will justify the implementation of countless long-term measures, ranging from new urban hygiene rules to the consolidation of medical systems and including policies to reduce mobility and contact.

The prospects for social reorganisation that can be imagined from the current health crisis are enormous. We have, therefore, decided to focus on Europe, about which we are much more certain than we are about the rest of the world. But certain trends of transformation will be the same everywhere.

Governance: strengthening regional and global policy coordination bodies – In the 2010s, the “populists” took over the technocracies of the 90s and 2000s, once again linking governance to the concerns of “the people”. That said, they still aren’t at the right level of power and, for at least a year, we have been analysing a transfer of their political agendas to supra-national levels. By affecting all economies without exception, COVID-19 considerably reinforces the relevance of the “major levels” of decision and action – much more surely than the migration crisis, for example, which led most EU countries only to pass the responsibilities on to border areas (Greece, Italy, Bulgaria, Spain); or the terrorist crisis, whose federating potential was ethically dangerous. The virus has a great quality: it is a “humanist”. Although the Chinese and Americans are starting to cast aspersions on one another each accusing the other of being at the origin of the problem, whether men, women, gays, heterosexuals, Jews, Arabs etc., the virus itself puts us all in the same bag. [14]

Inflation: towards a return – At the beginning of the health crisis, the much hoped for inflation receded.[15] But we don’t think this situation is set to last long or beyond the crisis. In reality, the disruption caused to supply and production chains will create a situation where production methods will become more expensive and will be forced to reorganise (knowing China has probably permanently turned part of the flow of its immense production machine back on itself) and goods will become scarcer as demand picks up again… even if oil prices remain below 50 USD/barrel. Another argument in favour of inflation is linked to the point on banks (below). Banks are loaded with reserves of liquidity from QE and it is this storage that has prevented monetary printing from producing galloping inflation.[16] If we are right, and European banks are set on a plan for the economic and financial reconstruction of the continent, this liquidity, when it comes out of their coffers, will recreate inflation. This mechanism could even carry a risk of hyperinflation, but if everything is in place to absorb this money in large modern infrastructure projects (railways, health, social, defence, AI…) as we analyse it, this trend should be contained.

Monetary system: the implementation of a new euro – Reversed inflationary trend would be a game-changer for the ECB, which would find itself dealing with issues that are more deeply rooted in its DNA, namely preventing excessive inflation.[17] But let’s not base our anticipations too much on this possible inflationary recovery.[18] More generally speaking, the common budgetary and fiscal problems that the members of the eurozone will face will allow members of the ECB’s Executive Board (until now polarised between hawks and doves on the themes of austerity and budgetary rigour[19]) to be brought closer together and a whole host of solutions to be implemented, including the digital euro, which will lead to a general upgrading of the single currency (described in our article of June 2019).

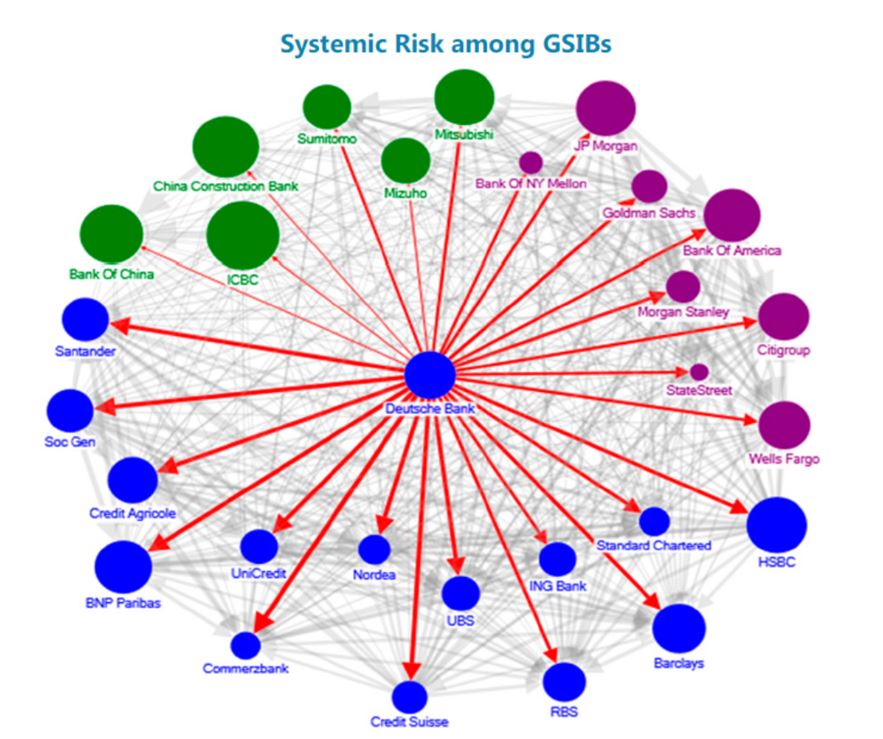

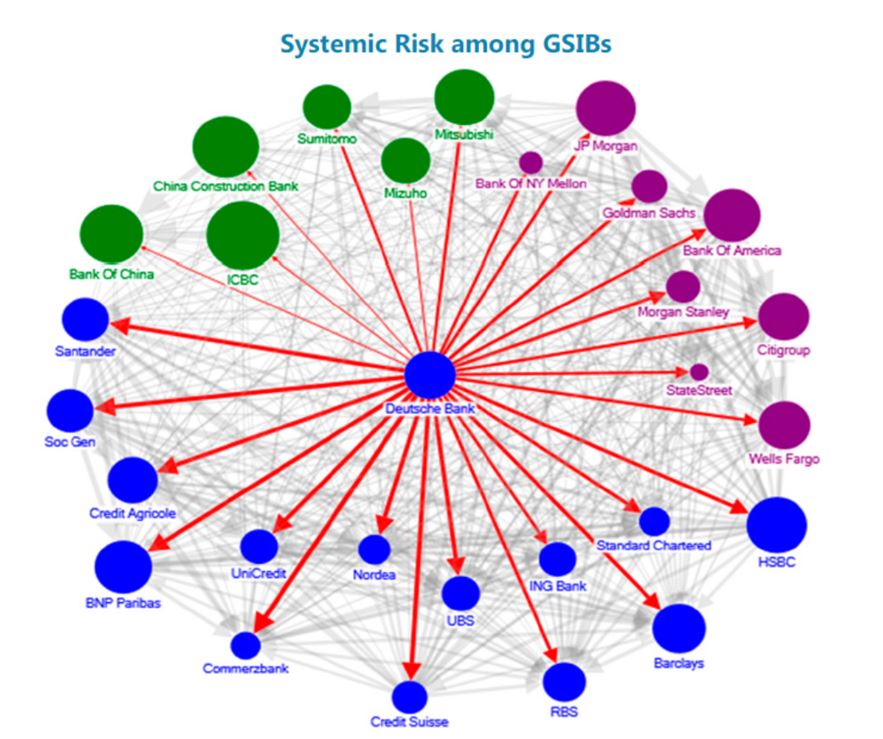

Banking system: The end of European banks as we have known them[20] – The current threat to the European (and American[21]) banking system of a Deutsche Bank failure[22] is being considerably aggravated by the health crisis, strengthening the bargaining power of the ECB vis-à-vis a banking system in the throes of collapse: actually, unlike in 2008, we can hope that the ECB will grow stronger as the European banking system weakens.

Figure 1 – Systemic risk, Deutsche Bank. Source: FMI, ZeroHedge

Login

Wars have undoubtedly generated plagues. But do plagues generate wars? From a systemic point of view, the pandemic should be enough to seal the fate of the old system, inaugurate [...]

2019 was a bumper year for US stocks and, while much of Europe and the Far East faced tougher growth conditions brought on by more local concerns (Brexit, Hong-Kong etc.), [...]

Markets/financial products - Do we really need to mention this? You don't need our insight to realise this, but for the sake of clarity: it's time to stay away from [...]

Comments