GEAB 156

The author of this analysis is an Indian member of our network of contributors. He casts an emerging country’s glance on these huge American stimulus plans.

The over $5 trillion stimulus plans signed by US Presidents Donald Trump and Joe Biden are aimed to boost consumer confidence, rebuild infrastructures and fuel the US economy to achieve the post-Covid target of 2% GDP growth. This plan will redirect international dollar cash flows to the US and generate a negative impact on emerging economies. Indeed American and/or USD FDIs as well as exports to the US have been central in the development of these economies. Our assumption is that in the post-Covid global economy, the US dollar will rise against emerging economies’ domestic currencies. Their dependence to the US, and most importantly to the dollar, will be strongly impacted, resulting in a decrease of their competitiveness on the global market. In the short term, it is a very dangerous perspective for their economic models; in the long term, it could result in a loss of power for the dollar in the global economy since the emerging countries will have no choice but to establish a stronger control on foreign capital flows, refocus their efforts on domestic capital investment, and diversify their currency foreign assets.

Login

As Biden puts the kibosh on US anti-China rhetoric - by reversing Trump's actions against TikTok and WeChat, for example - our team anticipates that a far more fundamental systemic [...]

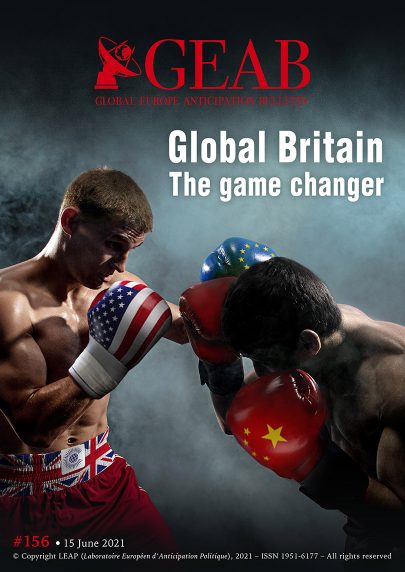

The concept of Global Britain was formulated in the early months following the 2016 referendum on the UK's decision to exit the EU. Theresa May and her teams have been [...]

Demographics are the “mother of change”. Indeed, the successive resizing of the global population is at the origin of the imperatives to transform the political-techno-economic systems that organise the human [...]

Trump was the seal of the populists’ era born in the wake of the gigantic crises of the last decade: Putin, Erdogan, Trump, Bolsonaro, Johnson... More fear than harm in [...]

The Espana 2050 project, presented by the Sanchez government on the 20th of May, brings together, in the form of 9 challenges, 50 objectives and 200 proposals, a set of [...]

Cryptocurrencies – Caught in the crossfire // Sport - Big changes ahead // Inflation/currencies - The great waltz // Consumption - After the greenwashing, here comes the localwashing // Oil [...]

Comments