GEAB 141

Bitcoin: Digital Gold

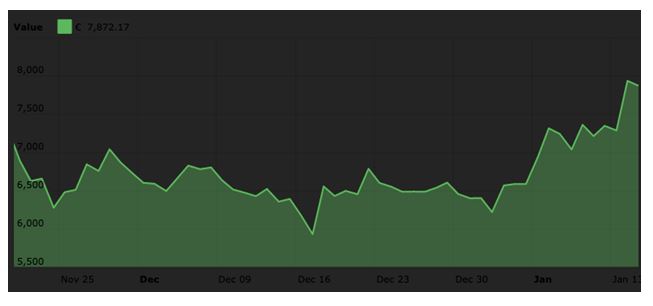

The fairly sharp rise in the price of Bitcoin at the time of the Iranian-American crisis confirms the intuition we had in June: Bitcoin is acting as a safe haven. This observation leads us to recommend that you keep your Bitcoin, or even add moderately to them, in the light of the twitches of the 2020 world. Apart from Bitcoin, some other cryptocurrency safe havens on offer include Ethereum, Litecoin and Ripple. Try Ekon as well – the gold-backed stablecoin offered in Switzerland. This gold-based crypto is probably a good way to protect your savings. Go easy, though; even if it’s Swiss, it’s far too new to be trusted blindly.

Figure 1 – Bitcoin price in euros, November 2019-January 2020. Source: courscryptomonnaies.com.

Blackrock: Mistrust

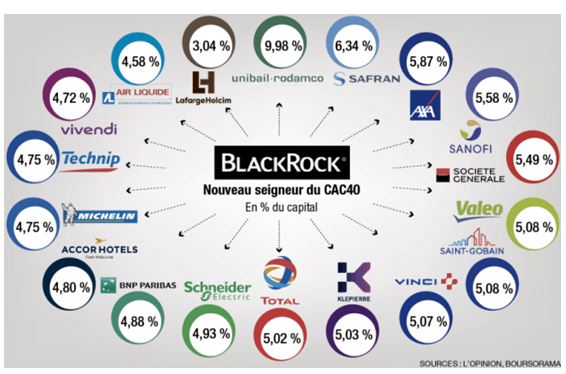

A little bird is telling us that it is not by chance that the French government chose to award the Legion of Honour to the CEO of Blackrock-France in the midst of demonstrations against pension reform… Without knowing exactly what is going on behind this ‘gaffe’, if we take a closer look at it, it turns out that Blackrock fears short-to-medium-term turbulences, primarily linked to the upcoming retirement of its visionary founder, Laurence Fink (the Steve Jobs of the Asset Management Dept.), and probably also to the pension fund crisis anticipated by low rates, low bond yields and concerns about active management. If you have shares in this company, or in companies in which Blackrock has shares, be wary.

Figure 2 – BlackRock’s French portfolio. Source: L’Opinon/Boursorama Login

A non-exhaustive review of global risk by continents/regions Geopolitical tensions will dominate the year 2020. From the most structural to the most cyclical, the reasons are: The multipolar world is [...]

As an introduction to our traditional January “key trends”, here are the main guiding lines that we have identified for this “phoney year ”. This first year of the new [...]

Briefly annotated, here are some important dates to keep in mind as we look ahead to 2020. 31st January: EU – Official exit of the UK The beginning of some [...]

As we do every year, GEAB by LEAP is presenting a landscape of the key trends for the coming year. Besides the intellectual value of this LEAP contribution, which, of [...]

Comments