GEAB 189

Eurozone: State bankruptcies on the horizon?

Stagflation, recession, rising credit costs, unemployment… the negative signals are multiplying for the eurozone economies. As the end of the year approaches, these indicators are going to hit the headlines and it is going to become increasingly complicated for governments to put on a brave face. The direct consequence is a loss of confidence on the markets, which immediately translates into an increase in the cost of public debt. Keeping an eye on the most heavily indebted countries (Greece (171.3%), Italy (144.4%), Portugal (113.9%), Spain (113.2%), France (111.6%) and Belgium (105.1%)[1], whose budget balances are the most fragile, will prove essential. The most prudent thing to do is to steer clear of them if you have investments in treasury bills, as our team believes that state bankruptcies can no longer be ruled out. Solidarity mechanisms at European level will certainly work, but not without turbulence.

Login

Will oxymorons ever run dry? The boring apocalypse is an astonishing concept, but one that resonates well at a time of rapid, sweeping change, where unprecedented, terrifying risks loom large [...]

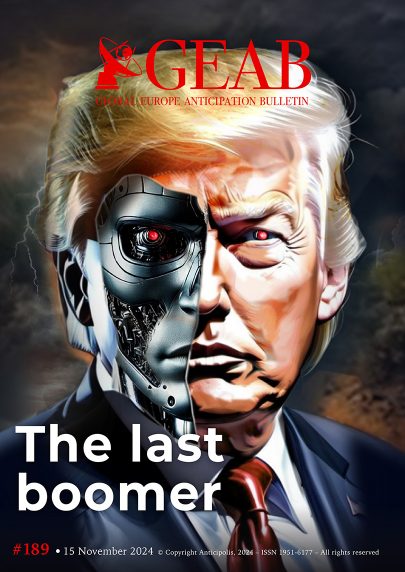

The triumphant re-election of Donald Trump symbolises the end of the baby-boomer generation’s dominance - their values, economic models and worldview - massively rejected, not just by a large majority [...]

While economic conglomerates may be on the decline worldwide, they remain the dominant force for foreign investment in Africa. This overview highlights the most influential structures on the continent, revealing [...]

In the coming years, the African continent will find itself more isolated than ever. Its relations with the global system and Western countries have reached a point of dysfunction that [...]

New emerging countries are making their mark on the international scene and positioning themselves as strategic markets. They represent the vanguard of growth drivers for a changing global economy, offering [...]

Comments