GEAB 155

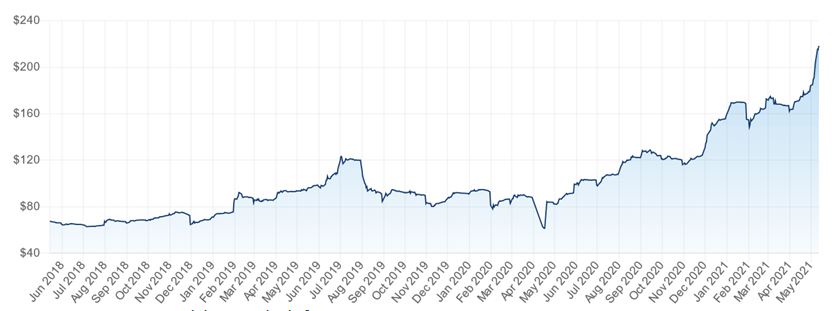

The price of the 2nd most traded commodity (oil being number one[1]) is soaring. At a time of recovery and infrastructure plans, and illustrating the “back to basics” trend, iron ore is the object of all sorts of lusts. While some incumbent interests prefer to optimise their margins by letting prices rise, others are working to open up the market by developing new mining sites. Everything seems to revolve around West Africa, and more specifically Guinea, which has the world’s largest unexploited deposit: Simandou.[2]

By 2026, things should have changed, a prospect which, as it becomes clearer, will cause increasing price volatility before it stabilises.

Fig. 1 – Iron ore prices – June 2018-May 2021. Source: MarketIndex, 2021

Login

The post-Covid world is multipolar, with at least three of the major poles competing for mineral resources and industrial production. Until recently, this competition was mainly reserved for the western [...]

Our universe is an ever-changing web of abundant energy, it is a central aspect of life and all human activity. Yet if we see energy through the lens of our [...]

To tackle a subject as complex as energy, the LEAP teams called on the collective intelligence of the GEAB, through the GEAB Café of 20 April, and the active participation [...]

One piece of business news with political significance: French and Italian media giants Vivendi (Bolloré) and Mediaset (Berlusconi) are throwing in the towel on their differences, each going their own [...]

Crypto-currencies: Maximum mistrust // Dollar : Standardisation // Technology stocks: Too virtual // Iron ore: Volatility in sight // Oil: Agility, security // If the “back to basics” trend that [...]

Comments