GEAB 158

Cash, gold, commodities and cryptos – A strong case

The above remarks reinforce our recommendations from last March “A short guide for investors in times of reflation/inflation“.[1] A new monetary system will soon be in place where fiat currencies will switch to ultra-fluid “exchange vehicles” such as digital currencies, a real monetary paradigm shift. If the exit goes badly, have cash, gold, commodities and crypto-currencies. If it doesn’t go too badly, have gold, commodities and crypto-currencies.[2] Ripple has just partnered with the Bank of England to design its future digital pound. We see this as an indication that time is indeed running out and that the long decision-making times of the BIS’s work no longer match the urgency of the situation… As we anticipated a year ago.

Login

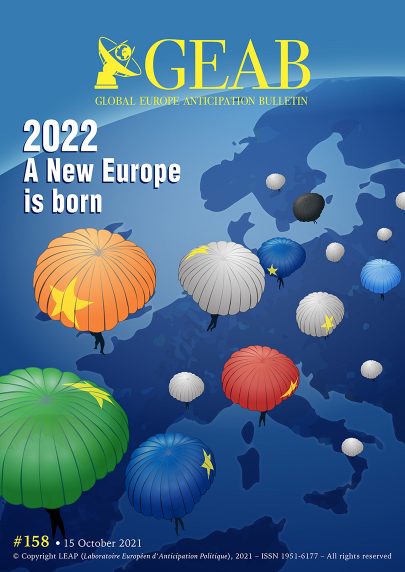

Six years after the announcement of the Brexit, five years after the transatlantic "shock" of Trump's election, a few months after the withdrawal from Afghanistan, our team anticipates that a [...]

The new military alliance between Australia, the United Kingdom and the United States (AUKUS) illustrates nothing more than a reheating of the Cold War between China and the West. In [...]

In 2024, the German military fighter planes that guarantee the country's role in NATO's nuclear sharing will be outdated. If this equipment is not replaced, Germany will no longer be [...]

Our team is always impressed by the broad vision provided by this exercise in exploring the future of the upcoming major political events. Whilst checking the following elections in Africa, [...]

Last August, Bernard Arnault (LVMH) overtook Jeff Bezos (Amazon) as world’s richest person. The luxury giants have performed brilliantly on the stock market. There is a lot of talk about [...]

The dollar will collapse only if the United States decides to let it collapse. The country is now in a situation where it is getting closer to having to make [...]

Comments