GEAB 189

In the coming years, the African continent will find itself more isolated than ever. Its relations with the global system and Western countries have reached a point of dysfunction that cannot be surpassed, and these ties are bound to be reexamined. Paradoxically, this situation grants African countries newfound freedom in choosing their alliances, which, magnified by the multipolar world, will compel them to unite.

The global debt system has run out of steam and is approaching obsolescence, forcing African countries to collectively invent new methods of financing investment. Many African countries that had access to international financial markets to finance their public debts in the 2000s and 2010s have seen this invitation turn into a trap[1]. Today, their ratings are downgraded and the repayment of debt has become unsustainable.

At the same time, the support of the developed countries with which the continent has forged partnerships is increasingly in question. Public finances are also in poor health in these countries, and the resurgence of nationalist rhetoric reflects an “every man for himself” mentality that affects not only migration policies but broader international cooperation as well.

The continent is therefore more than ever on its own. But this lack of support is bound to turn the balance of power on its head. Africa remains rich in natural resources, but also in human resources. And in a multipolar world, the potential alliances are multiplied. These difficulties in finding funding sources will therefore force a necessary transition that will push African countries to invent new models, to make the most of their assets, and to create new alliances that go beyond historical relationships of domination.

Login

Will oxymorons ever run dry? The boring apocalypse is an astonishing concept, but one that resonates well at a time of rapid, sweeping change, where unprecedented, terrifying risks loom large [...]

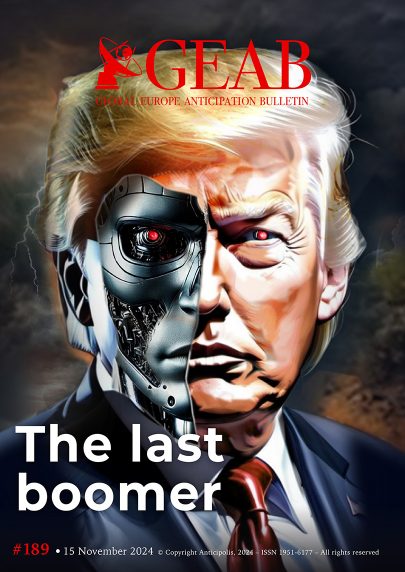

The triumphant re-election of Donald Trump symbolises the end of the baby-boomer generation’s dominance - their values, economic models and worldview - massively rejected, not just by a large majority [...]

While economic conglomerates may be on the decline worldwide, they remain the dominant force for foreign investment in Africa. This overview highlights the most influential structures on the continent, revealing [...]

New emerging countries are making their mark on the international scene and positioning themselves as strategic markets. They represent the vanguard of growth drivers for a changing global economy, offering [...]

Eurozone: State bankruptcies on the horizon? Stagflation, recession, rising credit costs, unemployment... the negative signals are multiplying for the eurozone economies. As the end of the year approaches, these indicators [...]

Comments