GEAB 110

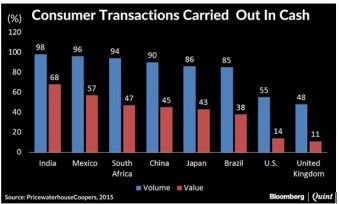

Since November 8, 2016, India has created a monetary revolution of a magnitude never seen, both by the size of the population concerned and the depth of the transformation induced. By demonetising the biggest notes of 500 and 1000 Rs (rupees), the Indian government is trying to reintegrate into the official economy the state’s gigantic parallel (or black or more simply the archaic) economy. In a nation where 90% of the transactions are made in cash, a huge part of the financial activity escapes the knowledge of the central government, and therefore statistics, taxes and infrastructure financing.

Blue: volume; red: value. Source: Bloomberg.

Warning signs

There is nothing new in the fact that the central government tries to force its population to declare their wealth. For example, between 1951 and 1997, no less than ten amnesty projects had been launched, encouraging citizens to declare their unofficial income in exchange for a simple payment of some increased tax[1].

Login

As we have already discussed and explained before, the crisis is now taking a more geopolitical form. Does this mean that the economic-financial crisis is over? No one will accuse [...]

Africa! The second largest continent in the world after Asia, both in size and population, and also one of the poorest is shaken by internal conflicts and wars. But above [...]

Each year in December, we evaluate our trend anticipations made in January. This month, we come across a final score of 25.5 out of 34, meaning a 75% success rate; [...]

Infrastructure versus sovereign bonds We have repeatedly emphasised this before: Donald Trump's campaign promises and the probable launch of “fiscal QEs” in Europe and in the US, offer a bright [...]

Comments