GEAB 173

The following article is the result of discussions between the GEAB editorial team and Dr Louis Arnoux. The latter’s work is far more alarmist than most research in the same field, namely the future of the oil industry and oil as a fuel for the world economy. The results and data discussed below, even though not yet published in any scientific journal, are interesting enough to be submitted for debate. On the one hand, by asking our readers to contribute to the production of our materials, we are attempting to create a collective intelligence of the future; on the other hand, because we believe that this research is moving in the irredeemable direction of history, namely the decline in the oil industry’s return on energy investment (more and more energy is needed to extract oil and therefore to fuel our production and consumption system).

Dr Louis Arnoux has worked Internationally with government bodies and business in matters of energy, oil, infrastructure and global development dynamics for over 50 years, most specifically concerning the dependence of the globalised industrial world on oil. He adopts a systemic approach towards the global energy supply and use system, analysing from the very start of production all the way to end uses. The approach he is working on with a few colleagues, focuses on the rapid evolution of the thermodynamics of the global energy supply and use system. His recent findings are much more alarming than other academic studies on the same issues and they are concerning global institutions, such as EIA, focusing on the peaking of oil in terms of supply and demand of volumes of crude oil (e.g., barrels per day). Login

Dragging in its wake the Silvergate and Signature banks, the Silicon Valley Bank’s bankruptcy (SVB) remains the sad event illustrating this GEAB issue of March: as analysed/anticipated over the past [...]

The exponential nature of the pace of innovation of all kinds is increasingly terrifying the Western human collective. Between frightened looks at the future, growing difficulties in adapting to change, [...]

We are not going to draw up a calendar of all the elections, but of those which seem to us to be the most significant. In 2023, for example, ten [...]

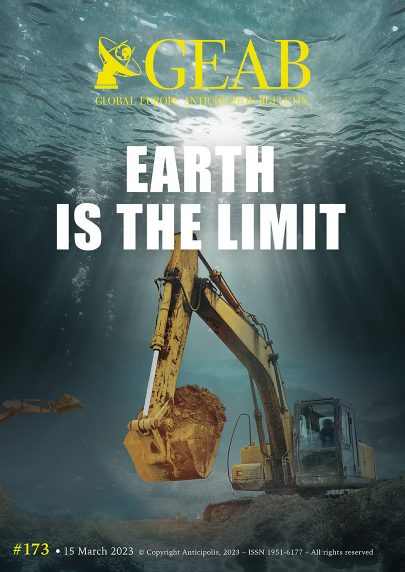

Last safe haven investment: the earth is the limit // June 2023: From war in Ukraine to a "pax americana-sinica"? // Gas: The future of oil // New Tech 2023: [...]

Comments