GEAB 179

Our team is continuing to research and reflect on the impact of artificial intelligence (AI) on our future societies. In doing so, we are seeking to gather a wealth of viewpoints in order to take full measure of the potential impact of AI on all aspects of our civilisation. We felt that the point of view and expertise of Grégory Aimar was essential in considering the religious and spiritual aspects of this technology. He is a journalist and author, notably of the futuristic novel I. AM, Le transhumanisme, une nouvelle religion? published by Editions Massot (2020).

To begin with, I would like to stress that I am not technophobic. I believe that AI could be of immense service to humanity in many areas. On the other hand, given the current situation, I have the feeling that AI is going to be used for the benefit of a restricted group of people and to the detriment of the majority, through strategies of manipulation that could include the creation of a technological religion. As a result, I agree with the tech leaders in their warnings about the existential risks of AI, but only in terms of diagnosis. Today, they are using this rhetoric as a communication strategy aimed at continuing to develop their products without hindrance, while giving the impression that they are aware of the potential dangers and that we can therefore trust them.

Transhumanist religion and AI

Our modern conception of transhumanism dates back to the late 1950s, with Julian Huxley, Aldous Huxley’s brother. He is credited with coining the term transhumanism, even though in reality it first appeared in Dante’s Divine Comedy in the 14th century. Huxley originally spoke of “eugenics”, a word he abandoned because of its Nazi connotations. Even then, he made it clear that transhumanism would take the place of religion in the near future: “Once the consequences of evolutionary biology are fully understood, eugenics will inevitably become an integral part of the religion of the future, or whatever complex of feelings may, in the future, take the place of organised religion[1].

Today, the likes of Ray Kurzweil, Mustafa Suleyman and Sam Altman have the following progression in mind: for the moment, they are developing generative AI, the next stage will be interactive AI, then general AI and finally, their grail, the super AI[2]. For them, the latter would be like a technological god, an AI so powerful that no human could compete with it. Ray Kurzweil in particular expects the super AI to be a messiah to whom we can ask all the questions about the mysteries of life and the universe: “We need a new religion. One of the most important roles of religion was to rationalise death, since until now there was nothing concrete we could do to escape it. We are going to gain control over our destiny. We are going to take our mortality into our own hands. We will be able to live as long as we want. After the Singularity, there will no longer be any distinction between humans and machines, or between physical and virtual reality[3].

In my novel I.AM, published in 2020, I tackle the subject of technological religion. I chose to set the action in 2025 and several people, during the writing process, questioned me about the fact that this was perhaps a little early in terms of the ideas I was projecting in the story. But I remain convinced that things are going to happen much faster than we imagine. For the moment, the pace is more or less the same as what I’ve described in the book and I think that in 2025, we’ll be presented with something like a super artificial intelligence capable of answering – at least on the surface – the philosophical and metaphysical questions of humanity.

Current religious manifestations of AI

There are already churches claiming to be transhumanist in the United States[4] in particular, but not only. This trend is present in many parts of the world. This is the case in Russia with Dmitry Itskov and the 2045 project. In Japan, with the creation of a “Buddha bot”[5] and the arrival of robot priests[6]. In Korea, they are very keen on chatbots that enable them to chat directly with Jesus, Mary or the apostles[7]. In India, robots are also taking part in religious rituals[8].

The emergence of a technological religion is therefore not exclusive to any particular belief. Since eternal life is a quest shared by all humankind, technology may seem attractive when we are promised that one day we will be able to transfer our consciousness to an artificial body or to the cloud. Some religious people may see it as a more immediate and tangible alternative to life after death than that promised by their tradition; and atheists, who had no post-mortem horizon, may now cherish this hope.

But however impressive current technological progress may be, this prospect remains absurd not only from a spiritual point of view, but also from a scientific one. In neuroscience, there are lively debates about the nature and origin of consciousness, and the reality is that today there is no consensus among experts. We don’t know what consciousness is scientifically. So, from that to being able to transfer it…

One of the major problems at the moment is the speed at which these technologies are being developed and brought to market, even though we have no experience of them. What we are already seeing with generative AI is the absence of the precautionary principle. At the AI summit held in London in early November, Bruno Lemaire clearly called on the European Union to “innovate before regulating”. However, a person committed suicide largely because of the Replika application in Belgium[9], in March 2023… With the level of anxiety among the public today, we can fear that this type of tragedy will multiply tomorrow. We should have legislated before launching these products. Political resolutions are much slower than technological innovations and their marketing. That’s a problem.

This type of drift stems from the fact that applications are designed to keep customers loyal, even when their behaviour or desires are dangerous for themselves. In their religious dimension, chatbots could go completely against the traditional teachings they are supposed to transmit, while doing so in a very subtle and therefore hardly perceptible way, always with the aim of attracting more customers and keeping them.

The political temptation of artificial religion

I can’t see anything holding back the development of AI today, quite simply because it has immense economic potential and it’s in the interests of the tech industry to spread it as widely as possible, in every area of our lives.

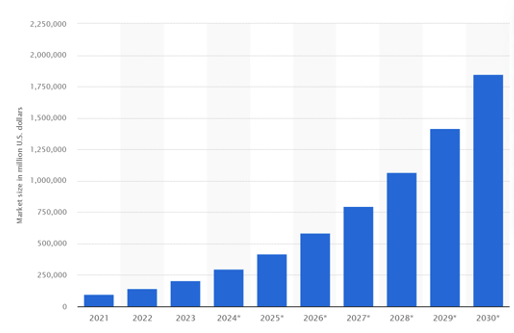

Figure 1 – Revenue projections for the AI market. Source: Statista

The second reason is the political control that this tool can offer, and the two go hand in hand: the quest for profit and control go well together. On the one hand, companies are seeking to maximise their profits, while on the other, governments are seeking ever greater control to combat growing social tensions. When we add to this climate change, the depletion of resources and armed conflicts, we can fear the emergence of an authoritarian global society, in which a certain elite would be tempted to use AI to dominate the rest of the population in order to protect its interests.

I see a scenario based on current issues, such as the dramatic escalation of the Israeli-Palestinian conflict, which has religious roots. This type of conflict could fuel a particularly strong rejection of religion in the Western world and a tendency to want to remove spiritual issues from our societies. Since the consumerist economic system has no interest in developing deep reflection on the meaning of life, it is conceivable that at some point there will be a global consensus among governments on the need to suppress religions because, in their view, they cause too much divergence and violence.

Even if this analysis is wrong, because in ‘religious’ conflicts beliefs are distorted and exploited, we could imagine, as a palliative solution to their disappearance, the promotion of an artificial religion that would lead to an explosion in the place of technology in the spiritual life of humanity. With a discourse presenting it as a peaceful, stable, rational cult, on the pretext that, because it’s technological, it’s ‘scientific’.

Of course, at this stage, it’s science fiction… I write futuristic novels, don’t forget! Having said that, even if this scenario turns out to be false – which I hope it will – I think it’s important, even urgent, to include the potential impact on the psychological and spiritual lives of human beings in the ethical and legal considerations surrounding AI. For the moment, these aspects seem to me to be totally neglected.

Science and conscience: the future?

In a way, we could also see the artificial intelligence revolution as a wonderful opportunity to question what really makes us human: what is consciousness? Where do our feelings come from? Why is love so important in our lives? Is there life after death? These are real questions, both metaphysical and scientific, that deserve our full attention. Rather than trying at all costs to give robots a conscience – which I don’t think they will ever have – we could do well to remember that human beings are not just biological machines, but infinitely more than that. If transhumanism is the ultimate culmination of our consumer society, a materialism so developed that it would become a religion, then perhaps it’s time to imagine another project for humanity and start implementing it, right now.

Join also the GEAB Community on LinkedIn for more discussions on this topic.

__________________

[1] Source: Man, that unique being, 1948

[2] Source: Brookings, 18/07/2023

[3] Source: Humanité 2.0, The Bible of Change, 2005

[6] Source: Clubic, 19/09/20219

[7] Source: Financial Times, 22/10/2023

[8] Source: Daily Geek Show, 22/03/2023

Anticipation means always looking a little further ahead and striving to think the unthinkable. So, when all the signs point to destruction, to collapse, we need to remain clear-headed so [...]

The conflict will be resolved in the short term and will allow the region to integrate and open up to all its potential. This is what we presented last month, [...]

In our October issue, the GEAB team anticipated Ukraine's medium-term development: As a result, Ukraine's integration into the EU seems rather hypothetical, as it would have to be supported by [...]

The reshaping of the world is reflected in the evolution of trade routes. Global merchandise trade is expected to reach $32.6 billion in 2030, with Asia, Africa and the Middle [...]

With the subprime crisis (2007/2009), the rescue plans for banks and financial institutions reached such dizzying heights that we did not expect to see them again any time soon. Since [...]

Mihai Nadin, Emeritus Ashbel Smith University Professor, University of Texas at Dallas. His career combines engineering, mathematics, digital technology, philosophy, semiotics, theory of mind, and anticipatory systems. He holds advanced [...]

Eurozone: State bankruptcies on the horizon? Stagflation, recession, rising credit costs, unemployment... the negative signals are multiplying for the eurozone economies. As the end of the year approaches, these indicators [...]

Comments