Category: investments

As we have already stated in various issues of the GEAB[1], agriculture as we know it is undergoing remarkable change. While we often see farming as a rural, analogue activity, there is a shift of perception of “food” among populations worldwide and we are starting to see that intricate connection between field and city-dweller’s plate […]

-> Monetary system: The reset is approaching fast -> Bitcoin: Indecision -> US Dollar: It’s all gone wrong -> Financial values: Making the right choices -> Ryanair/Airbnb and alike. Watch out -> Raw materials: Close up on … lithium Monetary system: The reset is approaching fast For the past two years, we have been […]

Material wealth: give nothing away Tomorrow’s world will be digital, that’s for sure. But not before it has been regulated, organised and controlled. As things stand today, there are too many dangers hanging over this ecosystem – soon to materialise, as we see in this issue – for us to entrust our goods and wealth […]

In the week we publish GEAB there are some very big events that we have to bring to your attention: 12-16 November: ASEAN summit / Vietnam. The debates focus on the immense risks that US-Chinese tensions pose to the region. 13 November: G20 / Saudi Arabia. The indebted countries of the G20 agree to lift […]

Even though the world is still counting its Covid deaths and assessing the consequences of this crisis onto its financial markets, economy and society, perhaps it is already time to wonder whether a second rogue wave is not already forming on the horizon, ready to sweep away the old Western socio-economic model next year. Contrary […]

Recommendations: Treasure hunt This issue is packed with investment recommendations. Car sector, raw materials, technology stocks… we suggest you read it carefully then go on a treasure hunt! Samsung: Temporary mistrust The current economic and strategic rapprochement between the Chinese and South Korean leaders[1] makes us fear American reprisals. One can imagine that it will […]

For the last 20 years, the international prices of many commodities have been set within a framework of globally recognised futures and spot contracts. Today, as many contracts detach from the delivery of the underlying physical commodity, volatility is surging on the back of QE and a host of new retail speculators have entered the […]

Commodity markets’ upcoming revolution Growing trade conflicts and de-globalisation within the commodity markets will trigger a rewrite of many COMEX pricing contracts and a resurgence in regional exchanges by 2025. For the last 20 years, the international pricing of key commodities has been driven by the growing market in futures contracts. Today, as many prices […]

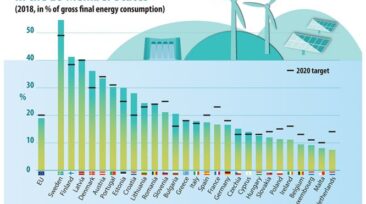

Many renewable energy sources have seen a dramatic increase in both their cost efficiency and their uptake by developed and developing economies. [1] European countries have done particularly well, with some exceeding their 2020 target during 2018. Yet, despite this, such sources can still only provide a small fraction of our total energy requirements and […]

At the risk of repeating ourselves, but in order to fight against the absolute blindness of the media system with regard to the digital revolution – albeit programmed – of all the fundamentals of the economy and world finance, here is a small summary of where the international monetary system is heading by 2025-2030. Following […]

Oil: Displacement of another centre of gravity China, the largest importer of oil, is about to finalise the security of its energy supply system. Its strategy is based on the diversification of resources (nuclear in particular), but as oil remains key to the stabilisation of the world economy, there is no question of leaving it […]

Digital data is the new black gold; the adage is familiar, but the stakes involved less so. With the COVID-19 pandemic, the world has achieved a two-year digital transformation within two months, says Satya Nadella, head of Microsoft. [1] In fact, the numbers are dizzying: before the health crisis, the Zoom videoconferencing platform had some […]

Insurances – The end of the system as we knew it According to Lloyd’s of London, the insurance industry will have to pay out $203 billion this year and professionals reckon that this pandemic represents the biggest catastrophe their sector has ever suffered. This economic crisis will be coupled with an existential crisis linked to […]

Markets/financial products – Do we really need to mention this? You don’t need our insight to realise this, but for the sake of clarity: it’s time to stay away from the financial markets. The strength of the evidence for this says a lot about the psychology of investors and its outlook for the market. Don’t […]

Gold: ready to shine even brighter? 2019 was a big year in Precious Metals (PMs). After two years of declining prices following the 2016 peak, a floor was reached around $1180 in August 2018 and the bull market ensued in line with our anticipations outlined in January 2019.[1] The summer saw a gain of over […]

Bitcoin: Digital Gold The fairly sharp rise in the price of Bitcoin at the time of the Iranian-American crisis confirms the intuition we had in June: Bitcoin is acting as a safe haven. This observation leads us to recommend that you keep your Bitcoin, or even add moderately to them, in the light of the […]

So January of the famous year 2020 has come! And with it comes our global panorama of trends and expectations. The task of presenting this is, perhaps, even harder than usual, at the dawn of a year capable of delivering the worst as well as the best, or even the worst in anticipation of the best […]

Corporate: Watch your back! The world is realigning itself according to its major regions. This trend, identified a long time ago by the GEAB and repeatedly validated, obviously doesn’t only concern government dynamics. It has direct consequences for companies as well. Particularly this one: don’t abandon your foundations! Certainly, a company needs to grow. And […]