GEAB 133

For the last hundred years the US dollar has fulfilled the role of an international reserve currency, smoothing international trade and providing liquidity to the financial markets in times of crisis. With many commentators now questioning the long-term security of dollar debt, are we seeing the beginnings of a shift to a new reserve currency based on the SDR and what role will gold play in this transition?

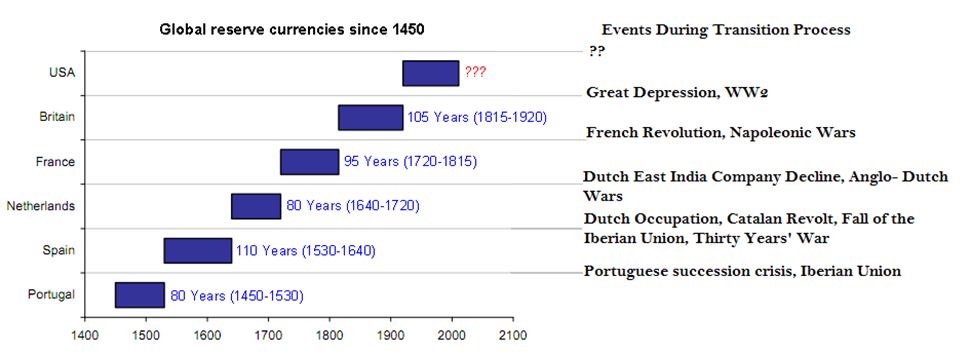

Figure 1 illustrates the recent transitions that have occurred between world reserve currencies and the way these are linked to shifts in the political or economic dominance of the originating nation. In 2019, we find ourselves confronted with a world which is facing challenges of a similar magnitude: One where economic power is moving east and political power is becoming increasingly dispersed around a multipolar world.

Figure 1 – Comparison of gold global reserve currencies since 1450: Chris Ferreira in Ecconomicreason.com[1]

Preparing for the coming transition – the rise of the SDR

During the period of the Breton Woods Agreement[2] (1944-1971), the US dollar grew in dominance to fulfil the role of a reserve currency to a degree never seen before. During this period, dollar strength was based on the promise that trading partners could exchange any surplus dollars for gold bullion. As time progressed, the growing economic power houses of the post-war world increasingly exported goods to America and took dollars in return. This led to a higher relative strength for the dollar and ultimately to trade imbalances which forced President Nixon to close the gold window.

Login

One of the major challenges of our next decade will almost certainly be the relationship between nation states and the world's major tech groups, known as GAFAM (Google, Amazon, Facebook, [...]

(A handbook for the actors of the European campaign) There is a lot about epilogues in this issue! In the case of the EU (a phase in the construction of [...]

Emmanuel Macron took power in order to serve a European agenda through the reintegration of France (marginalised since 2003 but without which there is no Europe) into the heart of [...]

We estimate that there is a very high (70%) probability of the imminent launch of a rapid and brutal birthing process of Greater Israel. Figure 1: Comparison between the presentation [...]

The future is this web made of all the threads humans weave between themselves and tomorrow. In the work GEAB teams have undertaken to understand the ‘web’ of the future, [...]

A reminder that our recommendations are not for speculative purposes, therefore short-term, that they don’t aim to win more, but rather to lose less (even nothing) because in the case [...]

Comments