GEAB 162

The monetary paradigm shift initiated around 2014 by China as part of the dual trend of “multipolarisation + digitalisation” is now launched at full speed. The followed paths are various, leading mid-term (2022-2025) to a global monetary dislocation with four main categories mentioned further below.

The end of capital immobilisation

The economy needs consumers. States need thriving economies. This seems obvious, but it is the first time in human history that nearly everyone has an interest in making the poor richer. Two problems occur here:

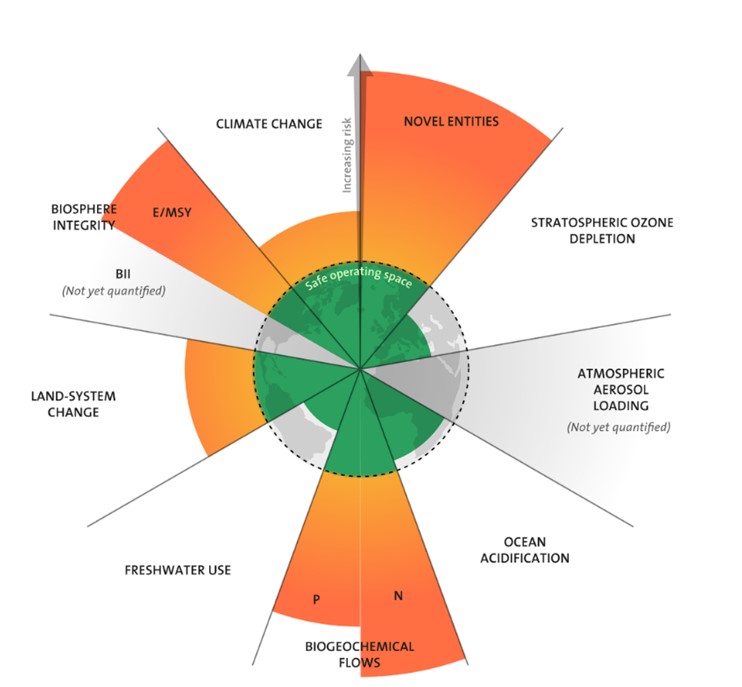

. How to transform the whole planet into consumers without running up against planetary boundaries? This is the so-called “environmental” problem requiring a change of economic paradigm made possible by newtech;

. How to include the whole of humanity in the global economic system without coming up against the physical limits of the current monetary system, known as ‘fiat’, which still persists? This is the problem of monetary inclusion that monetary digitalisation promises to resolve.

Figure 1 – Global limits and their status. Source: Stockholm Resilience Centre, credit: Azote for Stockholm Resilience Centre, based on analysis in Persson et al 2022 and Steffen et al., 2015

It is this second point that we will focus on here: when money ceases to be a vehicle and becomes a stock of value, it is concentrated in the coffers of the most powerful and ceases to innervate society, wealth gaps widen, and popular discontent increases (a discontent that can be expressed and organised very easily today, thanks to social networks), posing immense problems for the governments responsible for managing the masses. It is to avoid this breakdown that central banks have been printing so much liquidity for almost 15 years now. However, the only results have been breaking the credibility of the previous monetary model and seeing this money grow ever larger in the pockets of the powerful with very little effect on society. The system is therefore totally dysfunctional, because of the mono-national nature of the currency that is supposed to be the basis of the global economic system (i.e., the US dollar), but also because of its physical nature and, therefore, its heavy circulation.

The financial markets have made it possible to make capital mobility more fluid and to extend the sphere of the globalised economy, but they are based on this heavy monetary infrastructure as well as on national legal constraints and a pyramid of intermediaries (banks, financial institutions, insurance companies, pension funds, etc.). They make the complex structure even more cumbersome and can only feed a handful of multinationals that automatically win all the bets. Of course, they all claim to use this money to invest in the future of humanity, but it is the difficulties of the present which are exacerbated…

The future of money Login

The Fed published last month a timid report assessing the risks and opportunities of developing a central bank digital currency (CBDC). The document, marked by caution and patience, insisted that [...]

This geographical timeline and ranking has been developed primarily on the basis of researches carried out by the Atlantic Council (CBDC Tracker) and Madhvi Mavadiya (published in finextra). Based on [...]

There's nothing very original to say about the French election. Nevertheless... For over a year, our references of the upcoming presidential election have allowed us to see the arrival of [...]

As Russians and Americans clash on both sides of the EU's Eastern borders, let us summarise our analysis of the strategy being carried out and the objectives being pursued. In [...]

Agriculture is bad. Cow farts and meat are not good for the climate; animals suffer; not only do farmers use too many pesticides, but they also get too much money [...]

Meta/Facebook: Complications in sight Mark Zuckerberg's life has never been more complicated. Even he is questioning his free advertising-based model and is moving towards a Netflix-like model. Officially, he is [...]

Comments