Category: oil

Remember! Back in 2017 we anticipated that Saudi Arabia would soon be selling its oil in yuan? This was a highly provocative hypothesis at the time, since the country was then one of the two pillars of the petrodollar system.[1] Two years later, it became clear that export flows of Saudi oil were making a […]

Excerpt : GEAB 94 / Apr 2015 The Greek crisis is about to end… and it won’t be a European cheque which saves it but the fact that Greece is about to find the money to pay off its debt itself. Russia? The US? … Lack of political will to save Greece Since 2009 the […]

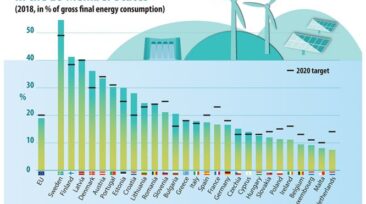

Many renewable energy sources have seen a dramatic increase in both their cost efficiency and their uptake by developed and developing economies. [1] European countries have done particularly well, with some exceeding their 2020 target during 2018. Yet, despite this, such sources can still only provide a small fraction of our total energy requirements and […]

Physical currencies: Speculative tour Currencies will lose value, but not all together. There are great opportunities within this volatile business environment for the more seasoned and agile among you. In general, currencies tied to the dollar will fall; while currencies pegged to the Chinese powerhouse and the euro will provide areas of currency stability. The […]

At the risk of repeating ourselves, but in order to fight against the absolute blindness of the media system with regard to the digital revolution – albeit programmed – of all the fundamentals of the economy and world finance, here is a small summary of where the international monetary system is heading by 2025-2030. Following […]

Oil: Displacement of another centre of gravity China, the largest importer of oil, is about to finalise the security of its energy supply system. Its strategy is based on the diversification of resources (nuclear in particular), but as oil remains key to the stabilisation of the world economy, there is no question of leaving it […]

Energy producers, distributors and investors worldwide are currently facing a triple whammy of falling demand, falling capacity and price wars that cannot fail to undermine the international corporate-based energy system that we have all come to rely on. Are countries doomed to repeat the errors of the past, or can the Green Movement work with […]

Businesses – Don’t expect a normal recovery in September! A growing proportion of economic and service players are aware of this, but it is worth hammering home the fact that we must anticipate that activity will not be able to resume in ex ante conditions in September. Therefore, everyone needs to take advantage of this […]

Is the US oil industry undergoing a significant shift in its relationship with its government, now accepting levels of influence or direct control that would have been unthinkable only a few months ago? Are the large oil companies, and the supply of energy they oversee, now so important to national security that they must be […]

At a time when the monomaniac media is drawing a smokescreen in front of everyone’s eyes, the GEAB, as always, is focusing its radars on what is going on behind this screen to determine what kind of world is really emerging – rather than those that people are hoping for – reaffirming our characteristic principle […]

Markets/financial products – Do we really need to mention this? You don’t need our insight to realise this, but for the sake of clarity: it’s time to stay away from the financial markets. The strength of the evidence for this says a lot about the psychology of investors and its outlook for the market. Don’t […]

Russia’s recent defection to OPEC+ is causing oil prices to plummet and causing the collapse of OPEC, according to the Wall Street Journal. These latest twists and turns in the oil crisis and everything related to it are in line with our anticipations, as for example this one dated June 2018: For the past two […]

Oil/Libya: War or US shale collapse? In Libya, General Haftar, mainly supported by the Americans, is not giving up. The reason is simple: he is acting under orders to block the oil wells of a country which is seeing its production collapsing, thus giving some support to the plunging prices of crude oil… and slowing […]

Bitcoin: Digital Gold The fairly sharp rise in the price of Bitcoin at the time of the Iranian-American crisis confirms the intuition we had in June: Bitcoin is acting as a safe haven. This observation leads us to recommend that you keep your Bitcoin, or even add moderately to them, in the light of the […]

As we do every year, GEAB by LEAP is presenting a landscape of the key trends for the coming year. Besides the intellectual value of this LEAP contribution, which, of course, reflects many of the analyses of our researchers over the last few months, we aim to provide a better understanding of the main issues […]

Corporate: Watch your back! The world is realigning itself according to its major regions. This trend, identified a long time ago by the GEAB and repeatedly validated, obviously doesn’t only concern government dynamics. It has direct consequences for companies as well. Particularly this one: don’t abandon your foundations! Certainly, a company needs to grow. And […]

Aramco’s IPO: another game-changer Saudi Aramco is a wonderful illustration of the problem that we see beginning to be solved in 2020 with the establishment of a new monetary and financial system – the old one being no longer in line with the global economy of the 21st century. Since 2018, we have regularly heard […]

Monetary Policy – beware of the direction change The shift towards the green colour of the economic indicators linked to the reduction in trade tensions at the end of the year, combined with the rebellion against accommodative monetary policies expressed by major central bankers, suggest a proportional reversal of the trend, particularly in key interest […]