Category: currencies

While the wave of buzz and hype around cryptocurrencies, or virtual currencies, is running out of steam among people in general,[1] the movement that has emerged remains robust. The versatility of the technology, its deployment in a digital context which can quickly reach millions of people, its potentially anonymous character and the place it could […]

News on the economic front is less severe. The recovery is expected to continue in 2018, partly on the basis of these various returns to slight forms of protectionism; a protectionism which, for now, is structured on the basis of large national and supranational entities, and stays open. It is a realignment rather than a […]

The link between debt and money creation is not a mystery. Generally, money is created to meet funding needs that anticipate equivalent wealth creation. Once gold was mined to create money for the exchange of manufactured wealth, but the end of the Bretton Woods agreement disconnected the link between money creation and gold to shift […]

Following the removal of the last of the bolts imposed by the previous world order[1], and in line with our anticipations, vast amounts of until now restrained transforming energy are now being released along paths that have long been marked out but were previously forbidden. The challenges raised by this transition are immense, but the […]

The construction of a federal structure for the eurozone got off to a bad start. The vision of the French government to strengthen the structure of the monetary union by creating new eurozone institutions, particularly a Ministry of Finance with its own budget and a convergence of business tax rates[1], already seemed like a somewhat […]

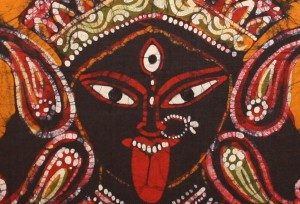

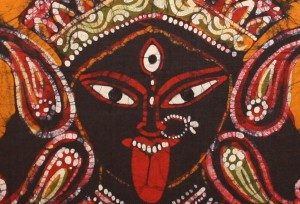

In view of Narendra Modi’s very probable re-election in 2019, it is time to take stock of the Indian Prime Minister’s first term; a somewhat mixed balance sheet, both economically and politically. The partial failure of the demonetisation scheme, the numerous SME bankruptcies, the prospect of a rural exodus of nearly 600 million people over […]

“Brexit means Brexit”[1]. For Theresa May, soft Brexit does not exist: an exit from the European Union necessarily means an exit from the European single market. Brexit therefore means hard Brexit for the British government. Within our GEAB bulletin no 103, we have already stated the possibility that the City might find itself “on the […]

An evaluation of our anticipations for 2017 (drawn from GEAB No 111 of January 2017): 75% successful

Each year in December, we release an assessment of our trend expectations presented last January. This time, we end up with a final score of 27 out of 36, meaning a 75% success, exactly the same percentage as in 2016. Currencies Dollar – End of the exceptional status: 1 « As we saw two months ago, […]

The city of London used to be an exceptional financial centre, by far the foremost in the world, a position it had owned for generations. Nevertheless, being attacked from all sides, it attempted with great effort to defend itself and demonstrated imagination and extensive accessibility but yet, eight years after the beginning of the global […]

The petrodollar system has been in agony for several years now. We wrote in our GEAB No. 100 that our team’s belief was that we were about to live through the final collapse of this system in 2016. Since it is the pillar of the current international monetary order, its fall will allow (even force) […]

When LEAP launched the GEAB in January 2006 with the object of describing a “global systemic crisis” in the making, one of its aims was to help raise awareness amongst Europeans of the US’ weakness and of the opportunity which then existed to complete the continent’s independence process. This objective was not only motivated by […]

For the fourth consecutive month, accompanied by all the usual precautions, our team continues to believe that the crisis’ peak is now behind us. It’s clear that two photos taken five minutes before and five minutes after this peak can be identical. On the other hand the film isn’t comparable; it’s that the perspective […]

The various quantitative easings, or other political stimuli and support for real estate, have prevented real estate prices to collapse as they should have done in the turmoil of the global systemic crisis. We say: “as they should have done”, because it was the only way of finally balancing delusional bubbles… Investments, trends and recommendations […]

. Invest in expanding one’s business on the Internet . And if the time of public investment returned… . A profession of the future: deconstruction . Digital currencies based on gold We never overestimate enough the magnitude and importance of the internet revolution – that some even call the third industrial revolution. Whether it is […]

The terrible 2014 Ukrainian crisis should be understood as an absolute limit beyond which the “world before” disappears no matter what. It will either disappear in the chaos and radicalization of the system which, in doing so, will cease to be itself, or it will disappear by opening up to the new characteristics of the […]

In the absence of a Europe able to indicate the true ways of the future[1], the « world before »[2] is hardening, locked into its “serious thinking” ideologies (ideologies are always “serious thinking”, moreover) and repeat the recipes of the past ad nauseam. In doing so, the “world afterwards” is finding itself transformed: it will be […]

For almost two years, by combining various points of view (speculative, geopolitical, technological, economic, strategic and monetary…), we have continued to anticipate a major crisis in the entire oil sector. Today, no one doubts the fact that we are actually at that point, and the GEAB must therefore anticipate the consequences of this veritable atomic […]