Category: dollar

Donald Trump’s victory in the US presidential election creates the conditions for change, but it is not change yet, contrary to what the media and populists believe. Far from being a “revolution”, the Trump’s advent at the head of the Western system corresponds to a radicalisation of the ex-ante situation. In reality, Trump is the […]

The United States has been voluntarily isolating itself from the rest of the world, and not just from a geopolitical point of view. This terrible isolation can only get worse, whatever the result of the presidential election: if Trump wins, it will be due to a lack of foreign policy; in the case of Clinton, […]

It seems that everything is going wrong for regional integrations. South America’s MERCOSUR trading bloc has completely stopped functioning, due to the marginalisation of Venezuela which currently holds the presidency of the Common Market, but that no one is following anymore. Another alliance currently chaired by Venezuela, the much less known NAM (Non-Aligned Movement), is […]

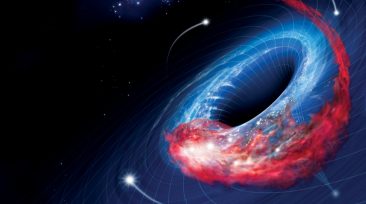

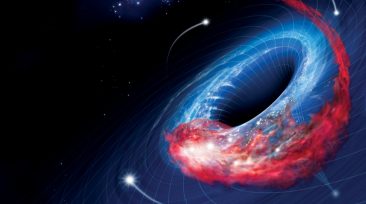

The world has been seeking a substitute for its reliance on the dollar since 2008. The dependency has been so strong, that it has taken almost a decade for a solution to be drafted. Strangely, this solution came from an institution perceived by some as obsolete, until China took the trouble to bring it back […]

Everyone remembers the images picturing floods, hail storms, mudslides, tornadoes and other disasters that have swept Europe, Germany, France, and Belgium recently, but also those of other continents (America, Australia, and Canada, where huge fires are still raging in Alberta). The estimated damage is reported to be in billions of Euros: 1.4 billion estimated in […]

In 2014, our team anticipated the disintegration of the Eastern European flank following the conflict between the EU and Russia. Two years later, the damage has become visible. If Europe and Russia fail to renew any dialogue, the worst is yet to come in this part of Europe, a region where old demons are in […]

Since 2006, when the GEAB bulletin was launched, our team has placed the emerging multipolar world at the heart of the global systemic crisis. The effects of the growing relativity of the American power were the first visible signs of a vast global reconfiguration. Then, in 2009, with the creation of the BRIC(S)[1] club, the […]

Precisely ten years ago (to the day), in its second bulletin of February 2006[1], warning about the imminent explosion of a «global systemic crisis”, the GEAB based its opinion on the identification of two strong signs: the end of the publication of the M3 money supply indicator[2] (suggesting a start to unusual degrees of the […]

The petrodollar system has been in agony for several years now. We wrote in our GEAB No. 100 that our team’s belief was that we were about to live through the final collapse of this system in 2016. Since it is the pillar of the current international monetary order, its fall will allow (even force) […]

Our team has chosen to place 2016 under the sign of a “general strategic retreat”, affecting all levels of social organization, starting of course with the national levels, but not only. This retreat (or fallback) will not yet represent in 2016 the end of the global mobility, of the international exchanges or of the internet, […]

We have repeatedly analyzed that only the regional powers would be able to restore calm in the Middle East and resolve the Daesh issue, the common enemy on which (almost) everyone has agreed. However, we have stated that the US or Russian interventions would only have the effect of exacerbating tensions. Repeatedly missed opportunities Suffice […]

For the fourth consecutive month, accompanied by all the usual precautions, our team continues to believe that the crisis’ peak is now behind us. It’s clear that two photos taken five minutes before and five minutes after this peak can be identical. On the other hand the film isn’t comparable; it’s that the perspective […]

We could have also headed our article : “No, the inflating of the Chinese stock exchanges isn’t a bubble”. The Shanghai stock exchange’s exuberant 100% increase in one year is certainly frightening, but it reflects a real dynamic (or rather a correction) of the country’s economic development. One really has to wonder how real money […]

The various quantitative easings, or other political stimuli and support for real estate, have prevented real estate prices to collapse as they should have done in the turmoil of the global systemic crisis. We say: “as they should have done”, because it was the only way of finally balancing delusional bubbles… Investments, trends and recommendations […]

Where must the EU’s boundaries stop? We often hear this question, but is it still relevant? The will to eventually integrate the Ukraine in the Union is one of the origins of the current crisis with Russia. The issue of reinforcing economic ties with the Ukraine should never have been a problem, however, except that […]

. Invest in expanding one’s business on the Internet . And if the time of public investment returned… . A profession of the future: deconstruction . Digital currencies based on gold We never overestimate enough the magnitude and importance of the internet revolution – that some even call the third industrial revolution. Whether it is […]

Whilst the US economy is off again at full speed without the Fed’s help, Europe is in such bad shape that it needs unprecedented quantitative easing by the ECB. That’s what one reads, in essence, in the majority of the media. But nothing is further from the truth. Here, we will endeavour to show on […]

The terrible 2014 Ukrainian crisis should be understood as an absolute limit beyond which the “world before” disappears no matter what. It will either disappear in the chaos and radicalization of the system which, in doing so, will cease to be itself, or it will disappear by opening up to the new characteristics of the […]