Category: euro

Euro: keep believing in it! The LEAP team now believes that the more we are told about the difficulties of the euro, the more we must hear “course change needed” rather than “end of the euro coming”. Euro exit threats are mostly brandished as part of the haggling and bargaining kind of negotiations currently taking […]

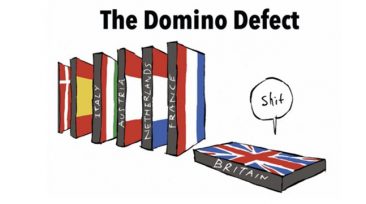

The post-Brexit Europe does not need the extreme right-wings, it is already lining up with the national-European model proposed by the British. The antagonism between European and national levels, which has dramatically increased within the crisis, due to a lack of democratic anchoring at the European level, has led in just 6 months to a […]

“Since there is no future, the wanderings of the past are back in Europe”. On this topic, our team finds interesting to identify some sort of an echo of the Continental Blockade[1] within the Brexit affair. There will be of course no strict parallel, but this parallel might show that Brexit is at least as […]

Strategic recommendation: remain covered Even though this GEAB bulletin is optimistic and sees the end of the transition tunnel focused on peace in the Middle East, we shall keep our warning of the last two months: remain covered until the end of the year! We are in the middle of a global geopolitical reconfiguration era, […]

Ten years after the Lehman Brothers collapse, the fear of another major financial crisis hasn’t totally disappeared. In a recent forum, Nouriel Roubini, one of the economists who had anticipated the 2007-2008 crisis, announced for 2020 the possibility of a new financial crisis, plunging the global economy into recession. For him, all the ingredients of […]

The construction of a federal structure for the eurozone got off to a bad start. The vision of the French government to strengthen the structure of the monetary union by creating new eurozone institutions, particularly a Ministry of Finance with its own budget and a convergence of business tax rates[1], already seemed like a somewhat […]

“Brexit means Brexit”[1]. For Theresa May, soft Brexit does not exist: an exit from the European Union necessarily means an exit from the European single market. Brexit therefore means hard Brexit for the British government. Within our GEAB bulletin no 103, we have already stated the possibility that the City might find itself “on the […]

As happens every year, LEAP/E2020 presents in January a panorama of the “up & down” main trends[1] of the coming year. Besides the intellectual added value of this contribution, which of course reflects many of the analyses our researchers made over the last few months, LEAP/E2020 aims to enable a better perception of priorities within […]

We can not help going back to the Middle East this month, simply because what is happening now looks so much like we had been anticipating for several years and announced at the beginning of 2017 in our list of “up and down trends”: Saudi Arabia’s emergence as a new strong player in the region, […]

– Iran … Germany, France and Norway have signed a series of contracts with Iran. They are not the only ones in Europe[1], despite the warnings and the risks which potential North American sanctions pose to European companies contravening the US policy[2]. The amounts of those contracts are significant and they refer to diverse sectors, […]

We anticipated this in May[1]: good news abounds in the eurozone, notably for the economic matters, with a “recovery” making Mr. Trump and Mrs. May jealous[2]. This even encourages the ECB to consider reducing its quantitative easing programme earlier than expected, namely in January[3], before halting it in September 2018. Investments go up, unemployment declines[4], […]

The “peer-to-peer economy” has increased extensively and suffered transformations due to the development of giant commercial players such as Airbnb. The growth of this tourist property-renting website between individuals is indeed quite impressive. Figure 1 – Number of travellers who use Airbnb each summer, 2010-2015. Source: Airbnb. Despite this dizzying curve as well as the […]

Qatar, North Korea, the Baltic Sea, risk of a World War III… and all the military ranting mentioned in the media lately, are issues going hand in hand with the programmed and imminent advent of the catastrophic scenario for the dollar as a unique world reference currency: the Petro-Yuan will be in place at the […]

Our loyal readers will not have been surprised by the result of Theresa May’s early election. Not only had we put in perspective a defeat of Theresa May, despite the favourable outcome given to her by the polls; but, from Greece to the United Kingdom, we keep repeating that there is no exit from Europe, […]

In the GEAB no 109 of November 2016 we wondered if “the euro would survive beyond the year 2017”. Five months later, we wish to deepen and complete our analysis. One reason for the weakness of the euro comes from the political anaemia of the euro zone, which is ultimately far too un-integrated to afford […]

The financial crisis followed by the debt crisis has led to a substantial change in the mandate of the European Central Bank (ECB) and to more political provisions. The ECB has acquired implicit mandates to safeguard the euro but also an economic policy which all go far beyond the original objective of price stability. The […]

Here and there[1] we may read some optimistic analyses on the European property market, saying either that the “revival” is here, that the sector is in good health, and so on. As our readers might guess, we are less enthusiastic and suggest the utmost caution in this regard, although the outlook is not uniformly and […]

February 15-16 / Astana: Next round of peace talks on Syria The peace in Syria initiative launched by Russia, Turkey and Iran in the wake of the December 29 ceasefire agreement continues. The capital of Kazakhstan, Astana, will be hosting a new meeting on February 15 and 16, to which the United States, the United […]